Here's Why Orbit Exports (NSE:ORBTEXP) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Orbit Exports Limited (NSE:ORBTEXP) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Orbit Exports's Debt?

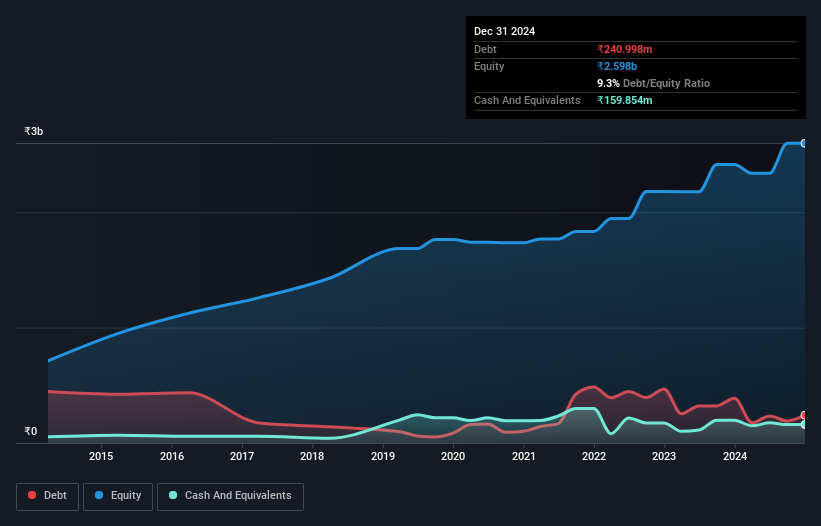

You can click the graphic below for the historical numbers, but it shows that Orbit Exports had ₹241.0m of debt in September 2024, down from ₹388.6m, one year before. However, because it has a cash reserve of ₹159.9m, its net debt is less, at about ₹81.1m.

A Look At Orbit Exports' Liabilities

We can see from the most recent balance sheet that Orbit Exports had liabilities of ₹365.0m falling due within a year, and liabilities of ₹268.7m due beyond that. Offsetting this, it had ₹159.9m in cash and ₹402.5m in receivables that were due within 12 months. So it has liabilities totalling ₹71.3m more than its cash and near-term receivables, combined.

This state of affairs indicates that Orbit Exports' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₹3.75b company is short on cash, but still worth keeping an eye on the balance sheet.

See our latest analysis for Orbit Exports

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Orbit Exports's net debt is only 0.16 times its EBITDA. And its EBIT easily covers its interest expense, being 109 times the size. So we're pretty relaxed about its super-conservative use of debt. On the other hand, Orbit Exports saw its EBIT drop by 6.9% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Orbit Exports will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Orbit Exports generated free cash flow amounting to a very robust 82% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that Orbit Exports's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But, on a more sombre note, we are a little concerned by its EBIT growth rate. Zooming out, Orbit Exports seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with Orbit Exports .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ORBTEXP

Orbit Exports

Manufactures and sells novelty fabrics in India and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)