Nandan Denim Limited's (NSE:NDL) Shares Leap 26% Yet They're Still Not Telling The Full Story

Nandan Denim Limited (NSE:NDL) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 137% following the latest surge, making investors sit up and take notice.

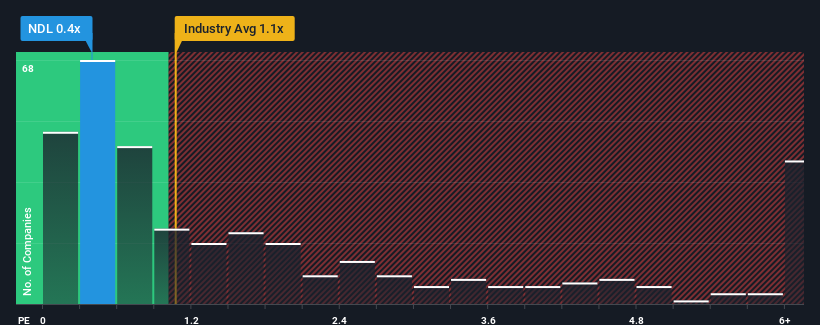

In spite of the firm bounce in price, it would still be understandable if you think Nandan Denim is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in India's Luxury industry have P/S ratios above 1.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Nandan Denim

How Nandan Denim Has Been Performing

The revenue growth achieved at Nandan Denim over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Nandan Denim will help you shine a light on its historical performance.How Is Nandan Denim's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Nandan Denim's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. The strong recent performance means it was also able to grow revenue by 56% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 13% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Nandan Denim's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Nandan Denim's P/S

Nandan Denim's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Nandan Denim revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Plus, you should also learn about these 4 warning signs we've spotted with Nandan Denim (including 2 which are significant).

If these risks are making you reconsider your opinion on Nandan Denim, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nandan Denim might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NDL

Nandan Denim

Engages in the manufacture and sale of denim and cotton fabrics, dyed yarns, shirting fabrics, and fibers in India.

Good value with proven track record.

Market Insights

Community Narratives