Lagnam Spintex Limited (NSE:LAGNAM) Stock Rockets 32% As Investors Are Less Pessimistic Than Expected

Lagnam Spintex Limited (NSE:LAGNAM) shares have continued their recent momentum with a 32% gain in the last month alone. The last month tops off a massive increase of 162% in the last year.

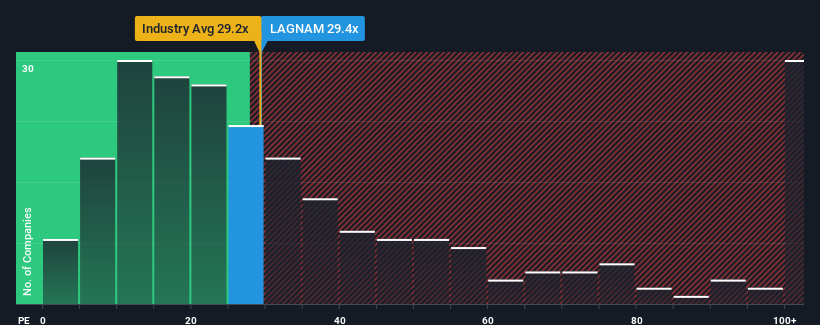

Although its price has surged higher, it's still not a stretch to say that Lagnam Spintex's price-to-earnings (or "P/E") ratio of 29.4x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 32x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, Lagnam Spintex's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Lagnam Spintex

How Is Lagnam Spintex's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Lagnam Spintex's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 42%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it interesting that Lagnam Spintex is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Lagnam Spintex's P/E?

Lagnam Spintex appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Lagnam Spintex currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 4 warning signs we've spotted with Lagnam Spintex (including 2 which make us uncomfortable).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LAGNAM

Lagnam Spintex

Manufactures and sells cotton yarns in India and internationally.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives