Kitex Garments Limited's (NSE:KITEX) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Kitex Garments to hold its Annual General Meeting on 30th of September

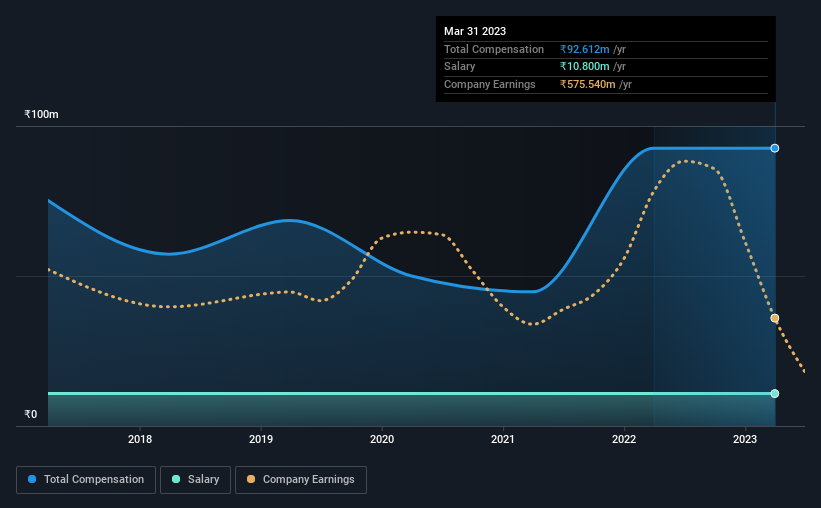

- Total pay for CEO Sabu Jacob includes ₹10.8m salary

- The overall pay is 272% above the industry average

- Kitex Garments' EPS declined by 34% over the past three years while total shareholder return over the past three years was 97%

Despite strong share price growth of 97% for Kitex Garments Limited (NSE:KITEX) over the last few years, earnings growth has been disappointing, which suggests something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 30th of September. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for Kitex Garments

Comparing Kitex Garments Limited's CEO Compensation With The Industry

Our data indicates that Kitex Garments Limited has a market capitalization of ₹13b, and total annual CEO compensation was reported as ₹93m for the year to March 2023. There was no change in the compensation compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at ₹11m.

On comparing similar companies from the Indian Luxury industry with market caps ranging from ₹8.3b to ₹33b, we found that the median CEO total compensation was ₹25m. This suggests that Sabu Jacob is paid more than the median for the industry. Furthermore, Sabu Jacob directly owns ₹5.3b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹11m | ₹11m | 12% |

| Other | ₹82m | ₹82m | 88% |

| Total Compensation | ₹93m | ₹93m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. In Kitex Garments' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Kitex Garments Limited's Growth Numbers

Kitex Garments Limited has reduced its earnings per share by 34% a year over the last three years. It saw its revenue drop 49% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Kitex Garments Limited Been A Good Investment?

Most shareholders would probably be pleased with Kitex Garments Limited for providing a total return of 97% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Kitex Garments that investors should look into moving forward.

Important note: Kitex Garments is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking to trade Kitex Garments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kitex Garments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KITEX

Kitex Garments

Manufactures and sells fabric and readymade garments for infants and children in India, the Unites States, and internationally.

Proven track record slight.

Similar Companies

Market Insights

Community Narratives