Do Kanani Industries' (NSE:KANANIIND) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Kanani Industries (NSE:KANANIIND). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out the opportunities and risks within the IN Luxury industry.

Kanani Industries' Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Kanani Industries grew its EPS from ₹0.092 to ₹0.29, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

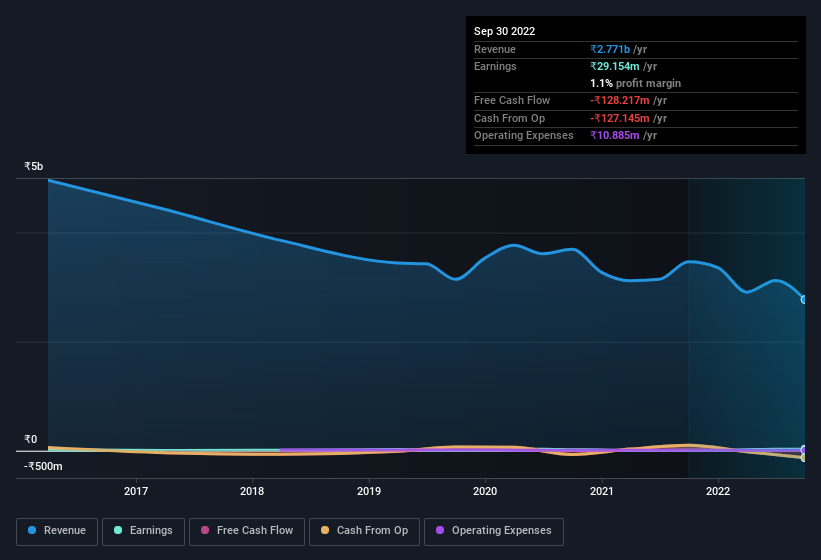

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Despite consistency in EBIT margins year on year, Kanani Industries has actually recorded a dip in revenue. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Kanani Industries isn't a huge company, given its market capitalisation of ₹1.2b. That makes it extra important to check on its balance sheet strength.

Are Kanani Industries Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Kanani Industries insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 77% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Although, with Kanani Industries being valued at ₹1.2b, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to ₹918m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Kanani Industries with market caps under ₹16b is about ₹3.6m.

The Kanani Industries CEO received total compensation of only ₹501k in the year to March 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Kanani Industries Deserve A Spot On Your Watchlist?

Kanani Industries' earnings have taken off in quite an impressive fashion. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that Kanani Industries is worth considering carefully. Still, you should learn about the 2 warning signs we've spotted with Kanani Industries (including 1 which is a bit concerning).

Although Kanani Industries certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kanani Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KANANIIND

Kanani Industries

Engages in the manufacture and export of diamond studded jewellery in India.

Flawless balance sheet and good value.