- India

- /

- Electrical

- /

- NSEI:UEL

Discovering 3 Hidden Gems in India with Strong Financial Foundations

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 4.7%, yet it remains up 39% over the past year, with earnings expected to grow by 17% annually in the coming years. In this dynamic environment, identifying stocks with strong financial foundations can offer promising opportunities for investors seeking stability and growth.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| Macpower CNC Machines | NA | 20.01% | 23.61% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| Om Infra | 13.99% | 43.48% | 23.30% | ★★★★★☆ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 20.60% | 62.92% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

BLS International Services (NSEI:BLS)

Simply Wall St Value Rating: ★★★★★★

Overview: BLS International Services Limited specializes in outsourcing and administrative tasks for visa, passport, and consular services to various diplomatic missions, with a market cap of ₹158.48 billion.

Operations: BLS International Services Limited generates revenue primarily from outsourcing and administrative tasks related to visa, passport, and consular services for diplomatic missions. The company has a market capitalization of ₹158.48 billion.

BLS International Services, a small-cap player in the professional services industry, has demonstrated strong earnings growth of 49.8% over the past year, surpassing the industry's 10.4%. The company’s debt to equity ratio improved significantly from 7.8% to 2.1% over five years, and it has more cash than total debt. Recent news highlights include a first-quarter net income of ₹1.14 billion (up from ₹689 million) and plans to raise up to ₹20 billion through various funding options approved by the board on August 5, 2024.

- Delve into the full analysis health report here for a deeper understanding of BLS International Services.

Gain insights into BLS International Services' past trends and performance with our Past report.

IFB Industries (NSEI:IFBIND)

Simply Wall St Value Rating: ★★★★★☆

Overview: IFB Industries Limited, with a market cap of ₹78.22 billion, manufactures and trades in home appliances both in India and internationally through its subsidiaries.

Operations: The company generates revenue primarily from its Home Appliances segment (₹36.32 billion) and Engineering segment (₹8.55 billion), with additional contributions from Steel (₹1.65 billion) and Motors (₹670.70 million).

IFB Industries has seen significant growth, with earnings surging by 612.7% over the past year, outpacing the Consumer Durables industry’s 17.4%. The company reported a net income of INR 375.4 million for Q1 2025, compared to a net loss of INR 6.2 million a year ago. Its debt to equity ratio climbed from 11.6% to 22.9% in five years, but it still holds more cash than total debt and maintains high-quality earnings with EBIT covering interest payments by 7.5x.

- Get an in-depth perspective on IFB Industries' performance by reading our health report here.

Review our historical performance report to gain insights into IFB Industries''s past performance.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited focuses on the generation of solar power in India and has a market cap of ₹40.75 billion.

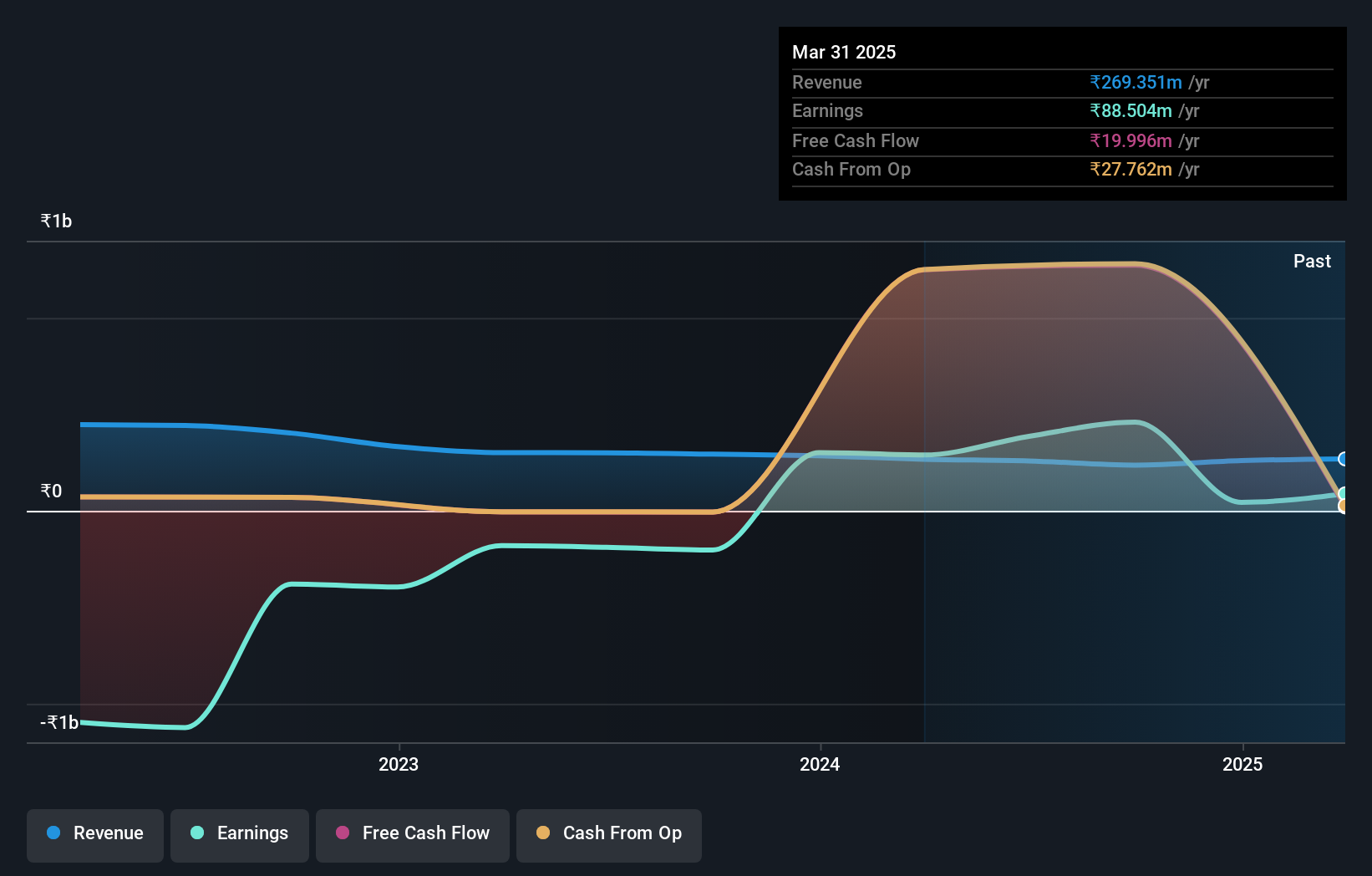

Operations: Ujaas Energy Limited generates revenue primarily from its Solar Power Plant Operation (₹297.31 million) and the Manufacturing and Sale of Solar Power Systems (₹172.52 million). The company also has a smaller revenue stream from EV-related activities amounting to ₹45.84 million.

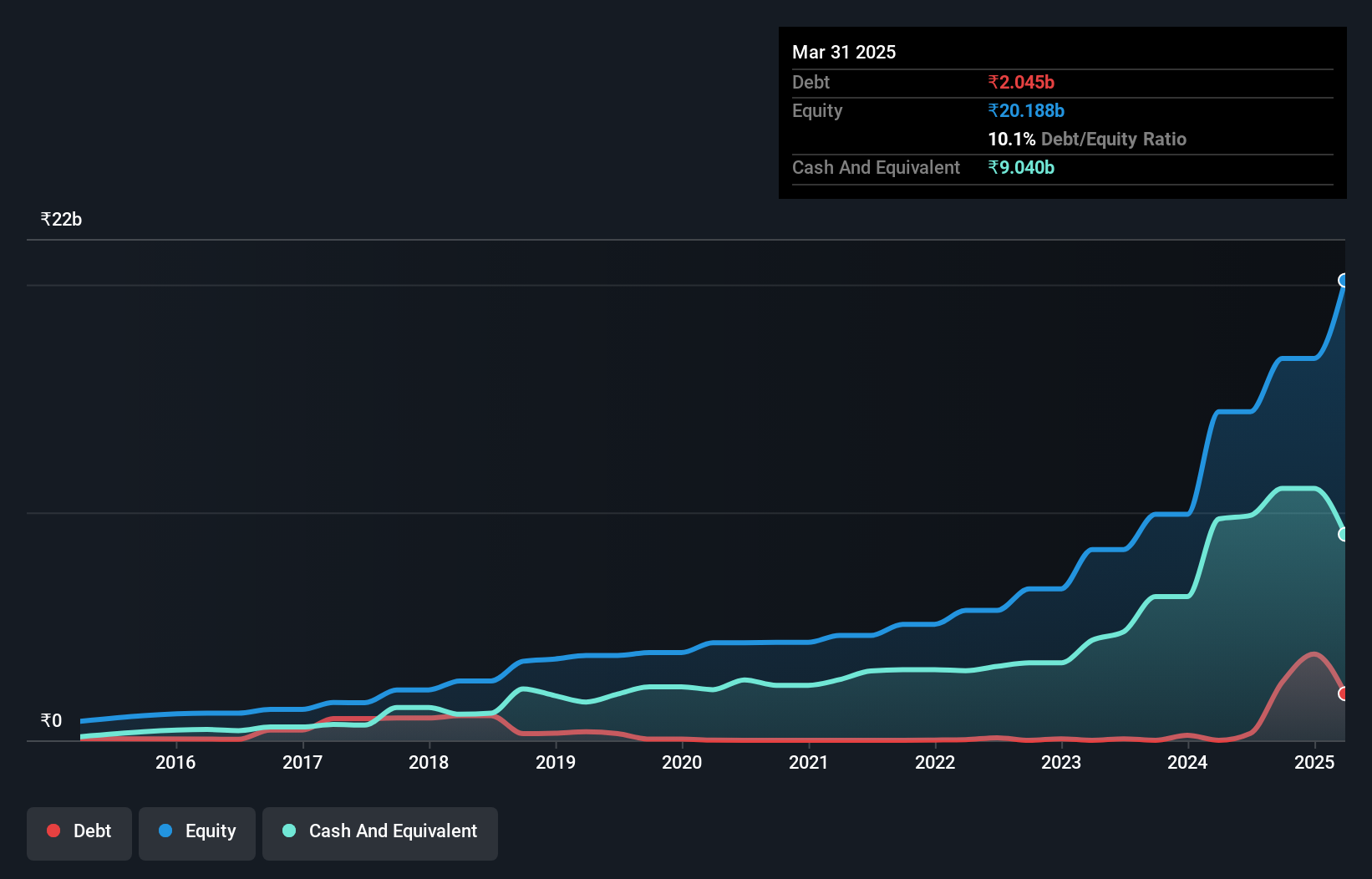

Ujaas Energy, a small cap in the renewable energy sector, has shown notable financial movements recently. The company reported full-year revenue of ₹528.73M for March 2024, up from ₹312.79M last year, despite a net loss of ₹41.44M in Q4 2024 compared to ₹34.62M the previous year. Trading at 70% below fair value, UEL's net debt to equity ratio improved significantly from 63.6% to 20.8% over five years while becoming profitable this year and achieving an EPS of ₹1.84 from continuing operations.

- Navigate through the intricacies of Ujaas Energy with our comprehensive health report here.

Explore historical data to track Ujaas Energy's performance over time in our Past section.

Taking Advantage

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 455 more companies for you to explore.Click here to unveil our expertly curated list of 458 Indian Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UEL

Excellent balance sheet with low risk.

Market Insights

Community Narratives