If You Like EPS Growth Then Check Out Goldiam International (NSE:GOLDIAM) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Goldiam International (NSE:GOLDIAM), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Goldiam International

Goldiam International's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Goldiam International has managed to grow EPS by 27% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Goldiam International's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that Goldiam International is growing revenues, and EBIT margins improved by 6.3 percentage points to 20%, over the last year. That's great to see, on both counts.

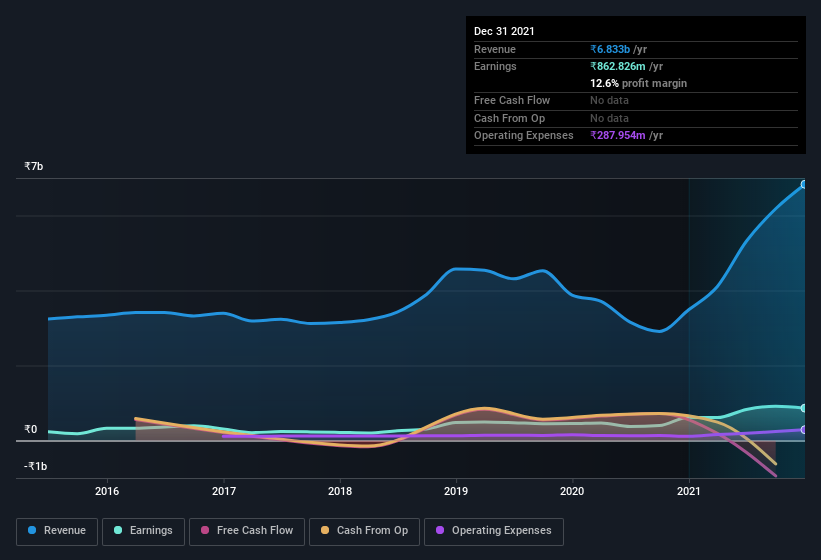

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Goldiam International is no giant, with a market capitalization of ₹14b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Goldiam International Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Goldiam International insiders own a meaningful share of the business. In fact, they own 70% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have ₹9.9b invested in the business, using the current share price. That's nothing to sneeze at!

Is Goldiam International Worth Keeping An Eye On?

For growth investors like me, Goldiam International's raw rate of earnings growth is a beacon in the night. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Even so, be aware that Goldiam International is showing 2 warning signs in our investment analysis , you should know about...

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GOLDIAM

Goldiam International

Manufactures, sells, and trades in diamond studded gold, silver, and platinum jewelry in India.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives