Do Cantabil Retail India's (NSE:CANTABIL) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Cantabil Retail India (NSE:CANTABIL), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

We've discovered 2 warning signs about Cantabil Retail India. View them for free.Cantabil Retail India's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Cantabil Retail India has managed to grow EPS by 23% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

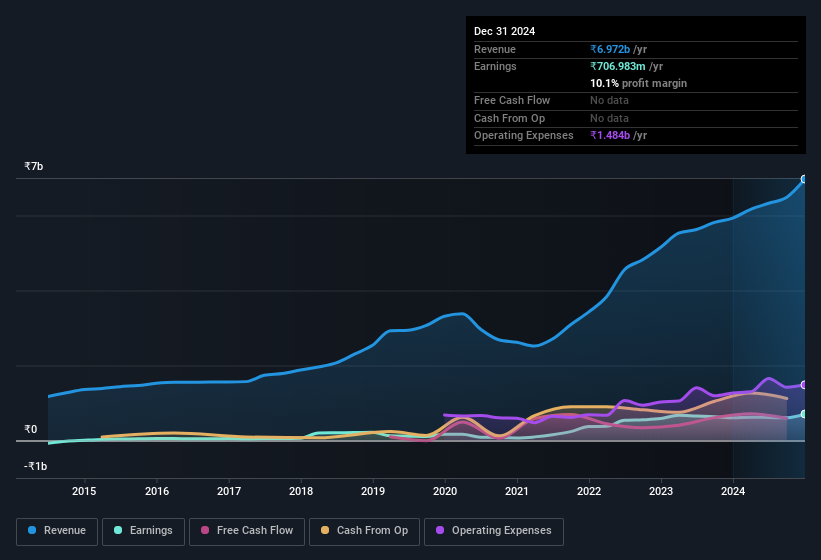

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Cantabil Retail India achieved similar EBIT margins to last year, revenue grew by a solid 18% to ₹7.0b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

View our latest analysis for Cantabil Retail India

Since Cantabil Retail India is no giant, with a market capitalisation of ₹20b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Cantabil Retail India Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that Cantabil Retail India insiders spent a whopping ₹149m on stock in just one year, without so much as a single sale. Knowing this, Cantabil Retail India will have have all eyes on them in anticipation for the what could happen in the near future. We also note that it was the Founder, Vijay Bansal, who made the biggest single acquisition, paying ₹81m for shares at about ₹217 each.

On top of the insider buying, we can also see that Cantabil Retail India insiders own a large chunk of the company. Indeed, with a collective holding of 76%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. In terms of absolute value, insiders have ₹15b invested in the business, at the current share price. That's nothing to sneeze at!

Is Cantabil Retail India Worth Keeping An Eye On?

For growth investors, Cantabil Retail India's raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. It is worth noting though that we have found 2 warning signs for Cantabil Retail India that you need to take into consideration.

Keen growth investors love to see insider activity. Thankfully, Cantabil Retail India isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CANTABIL

Cantabil Retail India

Engages in designing, manufacturing, branding, and retailing apparel and apparel accessories in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives