AYM Syntex (NSE:AYMSYNTEX) jumps 10% this week, though earnings growth is still tracking behind five-year shareholder returns

We think all investors should try to buy and hold high quality multi-year winners. While the best companies are hard to find, but they can generate massive returns over long periods. To wit, the AYM Syntex Limited (NSE:AYMSYNTEX) share price has soared 648% over five years. And this is just one example of the epic gains achieved by some long term investors. Better yet, the share price has risen 10% in the last week. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the stock has added ₹1.4b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for AYM Syntex

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

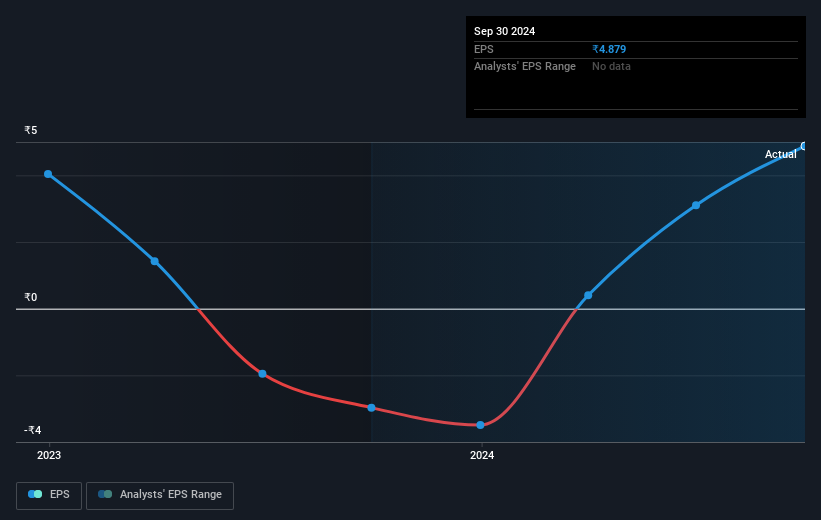

During the five years of share price growth, AYM Syntex moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into AYM Syntex's key metrics by checking this interactive graph of AYM Syntex's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that AYM Syntex shareholders have received a total shareholder return of 209% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 50% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand AYM Syntex better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for AYM Syntex you should be aware of, and 2 of them are concerning.

But note: AYM Syntex may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AYMSYNTEX

AYM Syntex

Manufactures and sells polyester filament, nylon filament, and bulk continuous filament yarns for the textile and floor covering industries in India, Australia, European Union, New Zealand, the United Kingdom, the United States, internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)