- India

- /

- Professional Services

- /

- NSEI:RELIABLE

Is Reliable Data Services (NSE:RELIABLE) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Reliable Data Services Limited (NSE:RELIABLE) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Reliable Data Services

How Much Debt Does Reliable Data Services Carry?

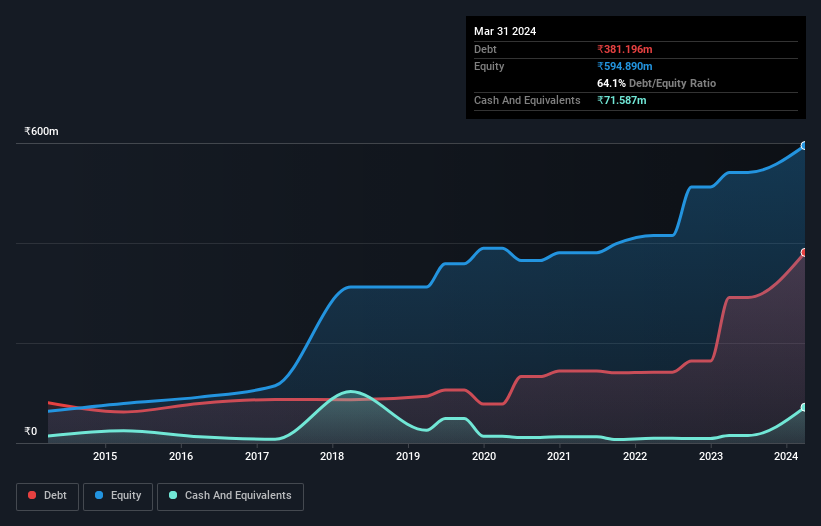

You can click the graphic below for the historical numbers, but it shows that as of March 2024 Reliable Data Services had ₹381.2m of debt, an increase on ₹291.0m, over one year. However, it does have ₹71.6m in cash offsetting this, leading to net debt of about ₹309.6m.

A Look At Reliable Data Services' Liabilities

According to the last reported balance sheet, Reliable Data Services had liabilities of ₹462.8m due within 12 months, and liabilities of ₹170.7m due beyond 12 months. Offsetting these obligations, it had cash of ₹71.6m as well as receivables valued at ₹573.2m due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

This state of affairs indicates that Reliable Data Services' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the ₹1.06b company is struggling for cash, we still think it's worth monitoring its balance sheet.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Reliable Data Services's net debt is sitting at a very reasonable 2.3 times its EBITDA, while its EBIT covered its interest expense just 3.5 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. One way Reliable Data Services could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 18%, as it did over the last year. There's no doubt that we learn most about debt from the balance sheet. But it is Reliable Data Services's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Reliable Data Services burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Reliable Data Services's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we thought its EBIT growth rate was a positive. Looking at all this data makes us feel a little cautious about Reliable Data Services's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Reliable Data Services has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RELIABLE

Reliable Data Services

Provides customized services to banking, financial services, and other manufacturing industries in the field of back-office processing, front office followups, and management services in India.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026