- India

- /

- Professional Services

- /

- NSEI:MITCON

Some MITCON Consultancy & Engineering Services (NSE:MITCON) Shareholders Are Down 38%

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the MITCON Consultancy & Engineering Services Limited (NSE:MITCON) share price is down 38% in the last year. That falls noticeably short of the market return of around -4.3%. MITCON Consultancy & Engineering Services hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 25% in about a quarter. That's not much fun for holders.

Check out our latest analysis for MITCON Consultancy & Engineering Services

We don't think that MITCON Consultancy & Engineering Services's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

MITCON Consultancy & Engineering Services's revenue didn't grow at all in the last year. In fact, it fell 39%. That looks pretty grim, at a glance. The stock price has languished lately, falling 38% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

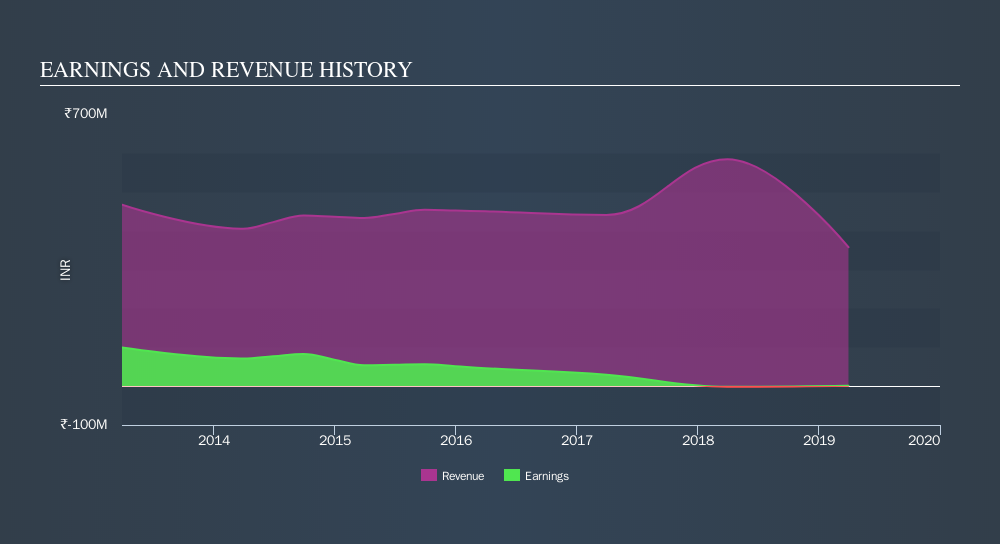

The graphic below depicts how earnings and revenue have changed over time.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

MITCON Consultancy & Engineering Services shareholders are down 38% for the year (even including dividends) , even worse than the market loss of 4.3%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 25%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of MITCON Consultancy & Engineering Services by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:MITCON

MITCON Consultancy & Engineering Services

Provides consultancy and training services in India.

Proven track record low.

Market Insights

Community Narratives