- India

- /

- Professional Services

- /

- NSEI:IPSL

What Integrated Personnel Services Limited's (NSE:IPSL) 31% Share Price Gain Is Not Telling You

Despite an already strong run, Integrated Personnel Services Limited (NSE:IPSL) shares have been powering on, with a gain of 31% in the last thirty days. The last 30 days bring the annual gain to a very sharp 68%.

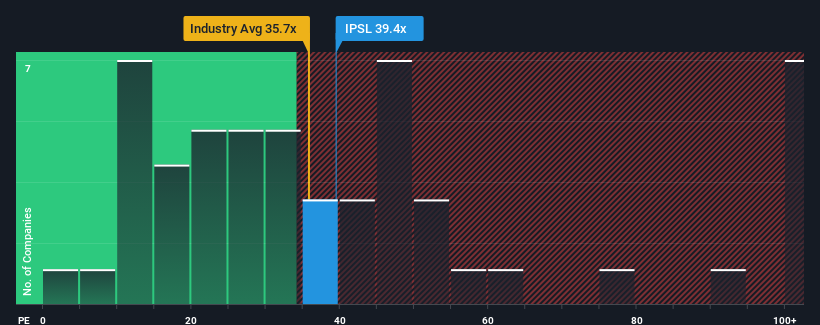

Since its price has surged higher, Integrated Personnel Services may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 39.4x, since almost half of all companies in India have P/E ratios under 31x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For example, consider that Integrated Personnel Services' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Integrated Personnel Services

How Is Integrated Personnel Services' Growth Trending?

In order to justify its P/E ratio, Integrated Personnel Services would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.3%. Still, the latest three year period has seen an excellent 97% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's curious that Integrated Personnel Services' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

What We Can Learn From Integrated Personnel Services' P/E?

Integrated Personnel Services shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Integrated Personnel Services currently trades on a higher than expected P/E since its recent three-year growth is only in line with the wider market forecast. When we see average earnings with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Integrated Personnel Services (at least 2 which shouldn't be ignored), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Integrated Personnel Services. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IPSL

Integrated Personnel Services

A human resource services company, engages in the provision of recruitment process outsourcing, and information technology and contract staffing services to various corporates in India.

Low with questionable track record.

Similar Companies

Market Insights

Community Narratives