- India

- /

- Professional Services

- /

- NSEI:IGIL

These 4 Measures Indicate That International Gemmological Institute (India) (NSE:IGIL) Is Using Debt Safely

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that International Gemmological Institute (India) Limited (NSE:IGIL) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

What Is International Gemmological Institute (India)'s Debt?

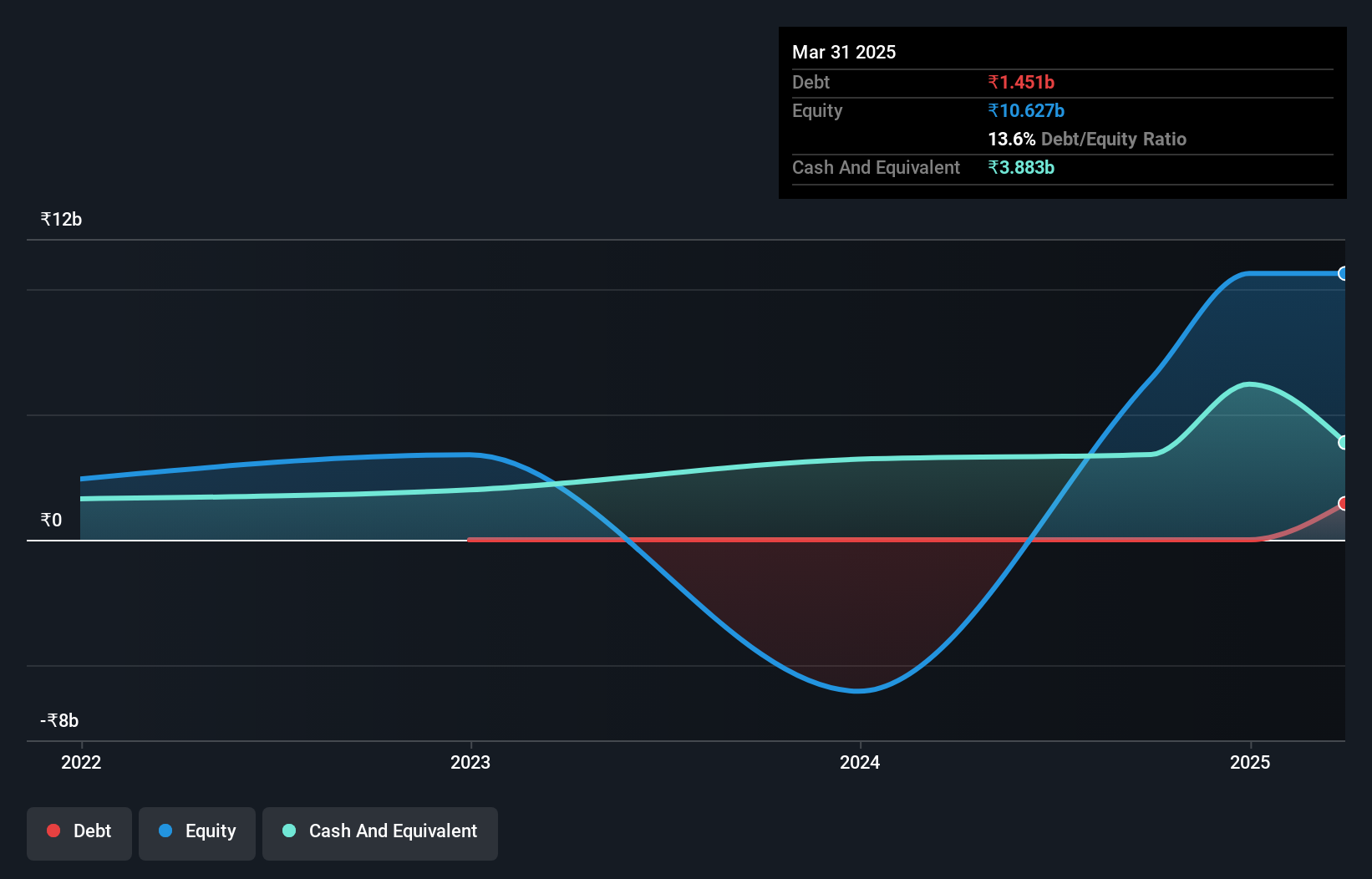

As you can see below, at the end of December 2024, International Gemmological Institute (India) had ₹1.45b of debt, up from ₹340.0k a year ago. Click the image for more detail. However, it does have ₹3.88b in cash offsetting this, leading to net cash of ₹2.43b.

A Look At International Gemmological Institute (India)'s Liabilities

According to the last reported balance sheet, International Gemmological Institute (India) had liabilities of ₹3.04b due within 12 months, and liabilities of ₹1.37b due beyond 12 months. Offsetting this, it had ₹3.88b in cash and ₹3.76b in receivables that were due within 12 months. So it can boast ₹3.23b more liquid assets than total liabilities.

This surplus suggests that International Gemmological Institute (India) has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, International Gemmological Institute (India) boasts net cash, so it's fair to say it does not have a heavy debt load!

Check out our latest analysis for International Gemmological Institute (India)

And we also note warmly that International Gemmological Institute (India) grew its EBIT by 20% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine International Gemmological Institute (India)'s ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While International Gemmological Institute (India) has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, International Gemmological Institute (India) recorded free cash flow worth 60% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that International Gemmological Institute (India) has net cash of ₹2.43b, as well as more liquid assets than liabilities. And we liked the look of last year's 20% year-on-year EBIT growth. So we don't think International Gemmological Institute (India)'s use of debt is risky. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of International Gemmological Institute (India)'s earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IGIL

International Gemmological Institute (India)

Engages in the certification and accreditation services for natural diamonds, laboratory grown diamonds, studded jewelry, and colored gemstones in India and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives