Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that DJ Mediaprint & Logistics Limited (NSE:DJML) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

What Is DJ Mediaprint & Logistics's Net Debt?

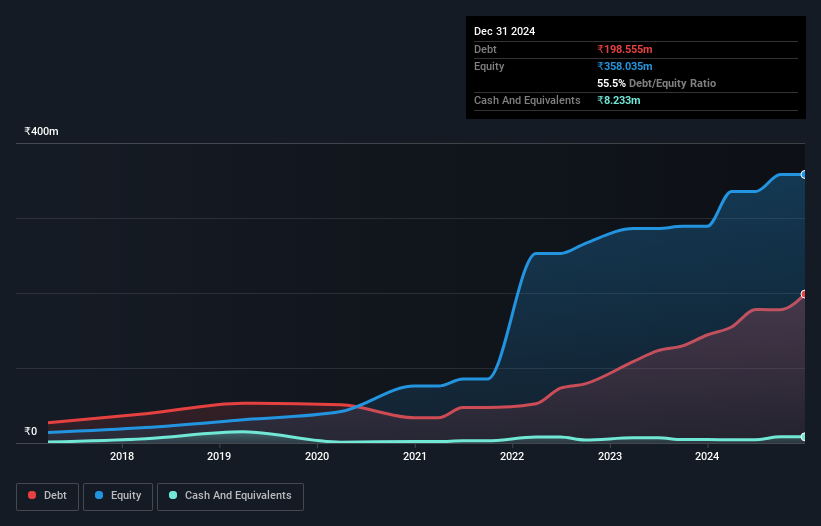

As you can see below, at the end of September 2024, DJ Mediaprint & Logistics had ₹198.6m of debt, up from ₹144.0m a year ago. Click the image for more detail. However, it also had ₹8.23m in cash, and so its net debt is ₹190.3m.

A Look At DJ Mediaprint & Logistics' Liabilities

According to the last reported balance sheet, DJ Mediaprint & Logistics had liabilities of ₹200.8m due within 12 months, and liabilities of ₹70.6m due beyond 12 months. On the other hand, it had cash of ₹8.23m and ₹288.3m worth of receivables due within a year. So it actually has ₹25.2m more liquid assets than total liabilities.

Having regard to DJ Mediaprint & Logistics' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the ₹3.83b company is struggling for cash, we still think it's worth monitoring its balance sheet.

See our latest analysis for DJ Mediaprint & Logistics

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While DJ Mediaprint & Logistics's low debt to EBITDA ratio of 1.1 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 5.9 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. It is well worth noting that DJ Mediaprint & Logistics's EBIT shot up like bamboo after rain, gaining 67% in the last twelve months. That'll make it easier to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since DJ Mediaprint & Logistics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, DJ Mediaprint & Logistics saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

DJ Mediaprint & Logistics's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to grow its EBIT is pretty flash. Considering this range of data points, we think DJ Mediaprint & Logistics is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for DJ Mediaprint & Logistics that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DJML

DJ Mediaprint & Logistics

Provides integrated printing, logistics, and courier solutions in India and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives