- India

- /

- Professional Services

- /

- NSEI:CAMS

Computer Age Management Services Limited (NSE:CAMS) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Computer Age Management Services Limited (NSE:CAMS) shares have had a horrible month, losing 26% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 34% in the last year.

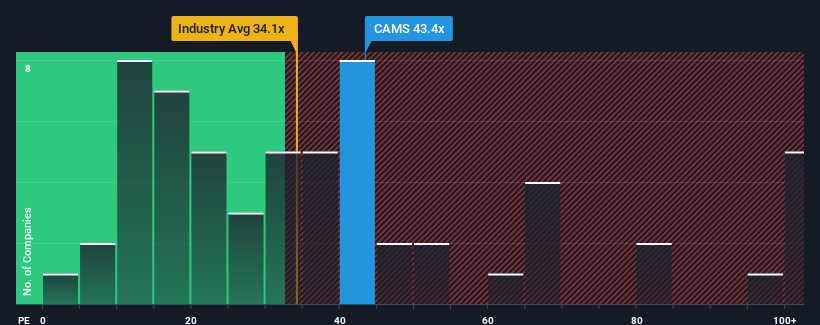

In spite of the heavy fall in price, Computer Age Management Services' price-to-earnings (or "P/E") ratio of 43.4x might still make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 29x and even P/E's below 16x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Computer Age Management Services certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Computer Age Management Services

Is There Enough Growth For Computer Age Management Services?

The only time you'd be truly comfortable seeing a P/E as high as Computer Age Management Services' is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 37% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 66% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 18% each year as estimated by the analysts watching the company. That's shaping up to be similar to the 20% each year growth forecast for the broader market.

In light of this, it's curious that Computer Age Management Services' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

There's still some solid strength behind Computer Age Management Services' P/E, if not its share price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Computer Age Management Services' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Computer Age Management Services that we have uncovered.

Of course, you might also be able to find a better stock than Computer Age Management Services. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CAMS

Computer Age Management Services

A mutual fund transfer agency, provides services to private equity funds, and banks and non-banking finance companies in India.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives