We Ran A Stock Scan For Earnings Growth And W.S. Industries (India) (NSE:WSI) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in W.S. Industries (India) (NSE:WSI). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

W.S. Industries (India)'s Improving Profits

In the last three years W.S. Industries (India)'s earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, W.S. Industries (India)'s EPS shot from ₹7.42 to ₹17.61, over the last year. It's not often a company can achieve year-on-year growth of 137%.

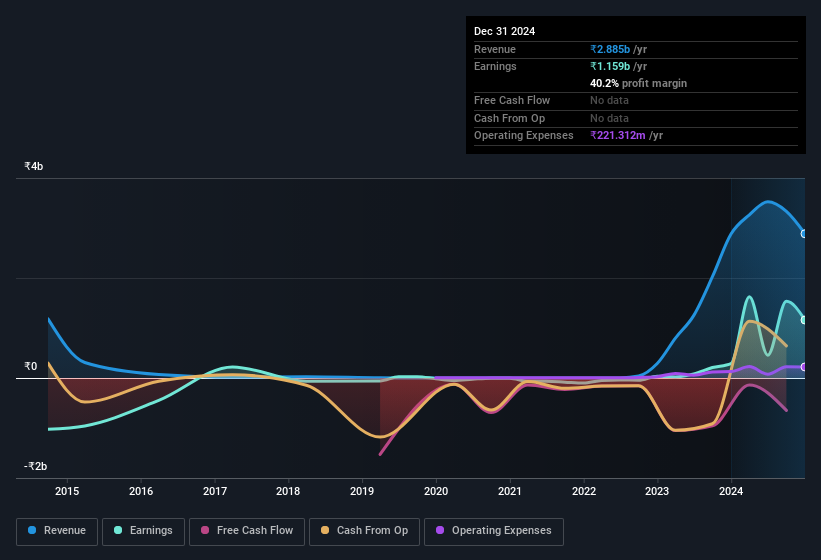

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. W.S. Industries (India)'s EBIT margins have fallen over the last twelve months, but the flat revenue sends a message of stability. Shareholders will be hopeful that the company can buck this trend.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Check out our latest analysis for W.S. Industries (India)

W.S. Industries (India) isn't a huge company, given its market capitalisation of ₹4.3b. That makes it extra important to check on its balance sheet strength .

Are W.S. Industries (India) Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that W.S. Industries (India) insiders spent ₹4.5m on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by company insider Sathiyamoorthy Anandavadivel for ₹2.6m worth of shares, at about ₹81.24 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for W.S. Industries (India) will reveal that insiders own a significant piece of the pie. In fact, they own 54% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. To give you an idea, the value of insiders' holdings in the business are valued at ₹2.3b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does W.S. Industries (India) Deserve A Spot On Your Watchlist?

W.S. Industries (India)'s earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe W.S. Industries (India) deserves timely attention. We should say that we've discovered 4 warning signs for W.S. Industries (India) (1 doesn't sit too well with us!) that you should be aware of before investing here.

The good news is that W.S. Industries (India) is not the only stock with insider buying. Here's a list of small cap, undervalued companies in IN with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if W.S. Industries (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WSI

W.S. Industries (India)

Operates as infrastructure development and electrical project handling company in India and internationally.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026