- India

- /

- Construction

- /

- NSEI:USK

Udayshivakumar Infra Limited's (NSE:USK) Subdued P/S Might Signal An Opportunity

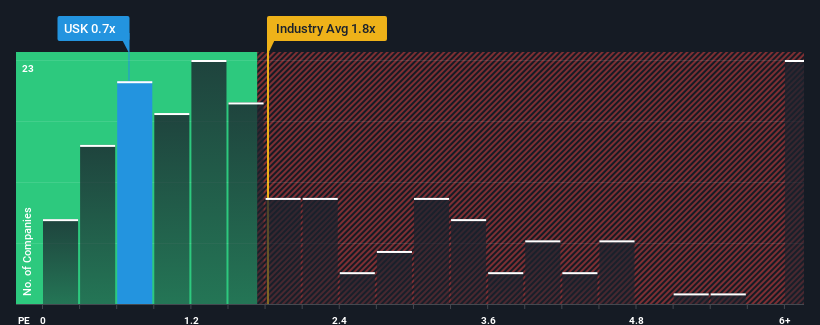

With a price-to-sales (or "P/S") ratio of 0.7x Udayshivakumar Infra Limited (NSE:USK) may be sending bullish signals at the moment, given that almost half of all the Construction companies in India have P/S ratios greater than 1.8x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Udayshivakumar Infra

How Udayshivakumar Infra Has Been Performing

For example, consider that Udayshivakumar Infra's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Udayshivakumar Infra, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Udayshivakumar Infra's Revenue Growth Trending?

In order to justify its P/S ratio, Udayshivakumar Infra would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 38%. Still, the latest three year period has seen an excellent 81% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Udayshivakumar Infra is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Udayshivakumar Infra currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Udayshivakumar Infra.

If these risks are making you reconsider your opinion on Udayshivakumar Infra, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:USK

Udayshivakumar Infra

Engages in the execution of infrastructure projects primarily in India.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives