Investors Interested In Timken India Limited's (NSE:TIMKEN) Earnings

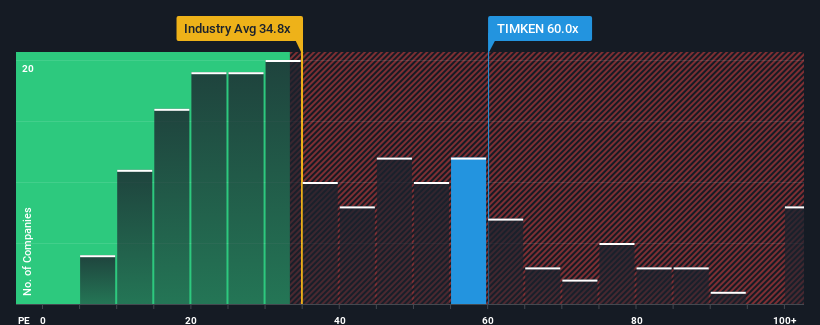

Timken India Limited's (NSE:TIMKEN) price-to-earnings (or "P/E") ratio of 60x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 31x and even P/E's below 17x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Timken India could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Timken India

How Is Timken India's Growth Trending?

In order to justify its P/E ratio, Timken India would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. Even so, admirably EPS has lifted 133% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 31% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 20% per annum growth forecast for the broader market.

With this information, we can see why Timken India is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Timken India's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Timken India maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Timken India with six simple checks on some of these key factors.

If you're unsure about the strength of Timken India's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Timken India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Timken India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIMKEN

Timken India

Manufactures and distributes tapered roller bearings, other roller bearings, components, and accessories for the automotive sector and railway industry in India, the United States, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives