Investors Appear Satisfied With Timken India Limited's (NSE:TIMKEN) Prospects As Shares Rocket 31%

Timken India Limited (NSE:TIMKEN) shares have continued their recent momentum with a 31% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 32% in the last year.

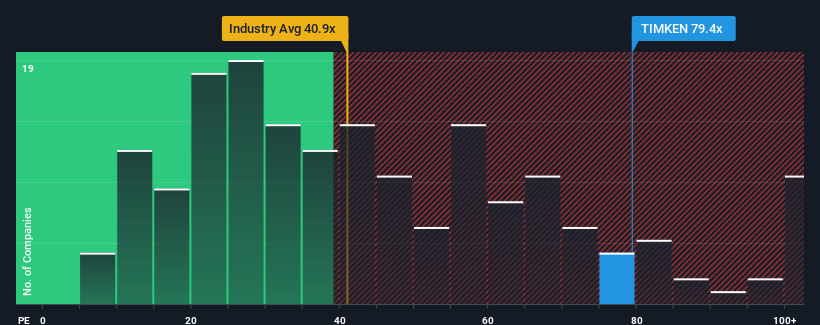

Since its price has surged higher, Timken India's price-to-earnings (or "P/E") ratio of 79.4x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 31x and even P/E's below 17x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Timken India could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Timken India

What Are Growth Metrics Telling Us About The High P/E?

Timken India's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 174% overall rise in EPS, in spite of its uninspiring short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 23% per year over the next three years. That's shaping up to be materially higher than the 21% per year growth forecast for the broader market.

With this information, we can see why Timken India is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Timken India's P/E

Timken India's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Timken India maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Timken India with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Timken India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIMKEN

Timken India

Manufactures and distributes tapered roller bearings, other roller bearings, components, and accessories for the automotive sector and railway industry in India, the United States, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives