- India

- /

- Construction

- /

- NSEI:TECHNOE

Discovering Undiscovered Gems On None In November 2024

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced increased pressure, with indices like the Russell 2000 reflecting this strain. Despite these headwinds, opportunities can still be found in undiscovered gems that demonstrate resilience and potential for growth amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Techno Electric & Engineering (NSEI:TECHNOE)

Simply Wall St Value Rating: ★★★★★★

Overview: Techno Electric & Engineering Company Limited offers engineering, procurement, and construction services to the power generation, transmission, and distribution sectors in India with a market capitalization of ₹168.36 billion.

Operations: Techno Electric & Engineering's primary revenue stream is derived from its engineering, procurement, and construction (EPC) services segment, generating ₹15.94 billion. The company's market capitalization stands at ₹168.36 billion.

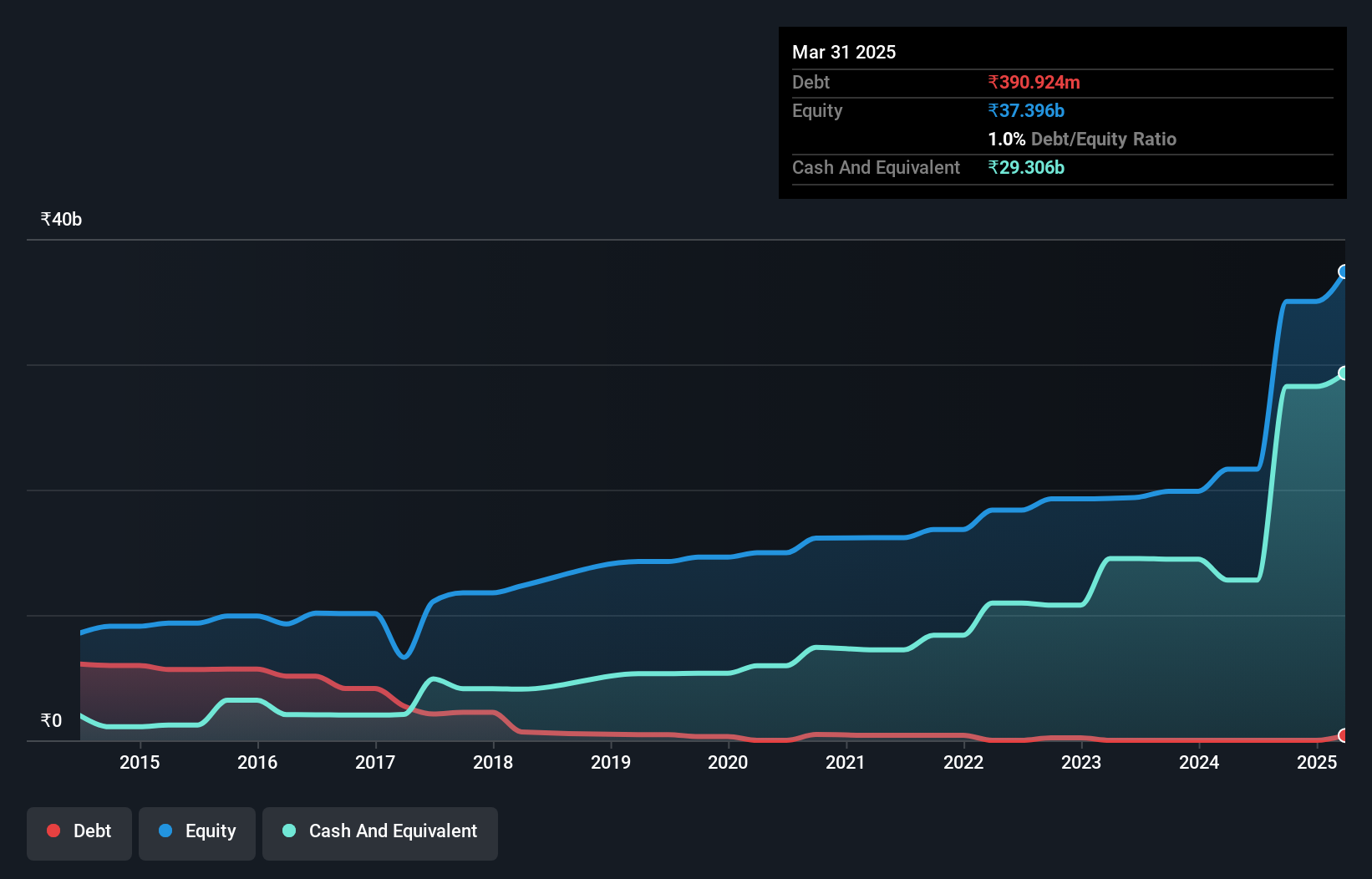

Techno Electric & Engineering, an intriguing player in the infrastructure sector, has shown remarkable financial performance. The company reported a net income of INR 981 million for the first quarter ending June 2024, compared to INR 253 million a year earlier. Earnings per share jumped to INR 9.12 from INR 2.35 in the same period last year. Despite being debt-free now, it had a debt-to-equity ratio of 3.2% five years ago, highlighting significant financial improvement. With earnings growth outpacing the construction industry at nearly 200%, Techno is making strides with its Edge Data Centers initiative across India and strategic alliances in greenfield projects.

- Dive into the specifics of Techno Electric & Engineering here with our thorough health report.

Understand Techno Electric & Engineering's track record by examining our Past report.

Bangkok Life Assurance (SET:BLA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bangkok Life Assurance Public Company Limited, along with its subsidiaries, offers life insurance services to individuals and corporates in Thailand and has a market cap of THB43.12 billion.

Operations: Bangkok Life Assurance generates revenue primarily through its life insurance business, amounting to THB45.74 billion.

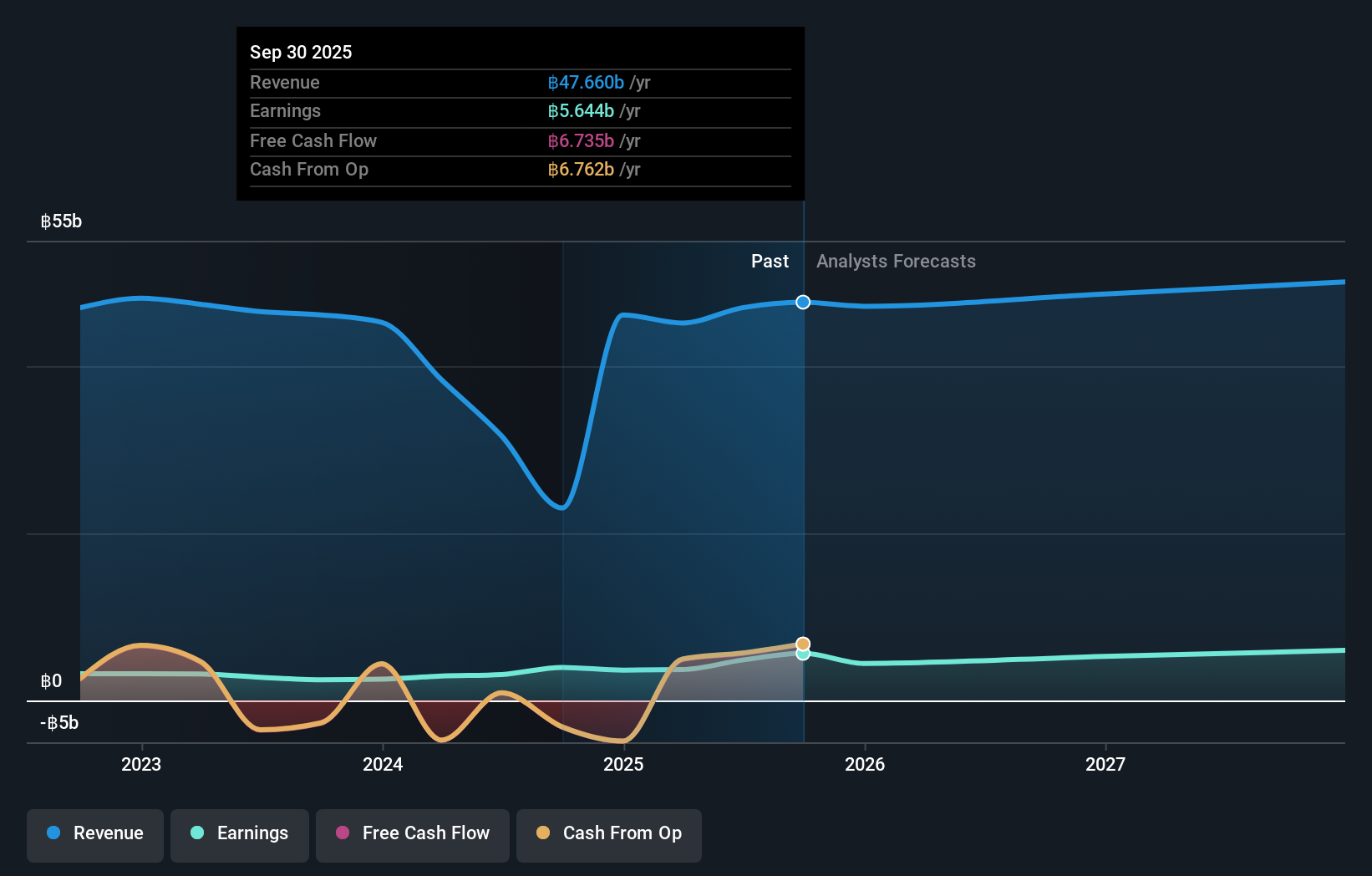

Bangkok Life Assurance, a smaller player in the insurance industry, has demonstrated robust earnings growth of 10.5% over the past year, outpacing the industry's 6.3%. Trading at 4.2% below its estimated fair value suggests potential undervaluation. With no debt on its books for five years and high-quality earnings reported, it appears financially sound. Recent figures showed Q2 revenue at THB 10.62 billion and net income of THB 813 million, both up from last year’s numbers. However, it was recently dropped from the FTSE All-World Index and announced a reduced interim dividend of THB 0.20 per share in August 2024.

- Click to explore a detailed breakdown of our findings in Bangkok Life Assurance's health report.

Assess Bangkok Life Assurance's past performance with our detailed historical performance reports.

Reach Machinery (SZSE:301596)

Simply Wall St Value Rating: ★★★★★☆

Overview: Reach Machinery Co., Ltd. focuses on the research, development, production, and sale of components for automation equipment, power transmission, and braking systems both in China and internationally with a market capitalization of CN¥4.09 billion.

Operations: Reach Machinery generates revenue primarily from its Machinery & Industrial Equipment segment, which reported CN¥599.22 million. The company's financial performance can be evaluated by examining its gross profit margin or net profit margin trends over time.

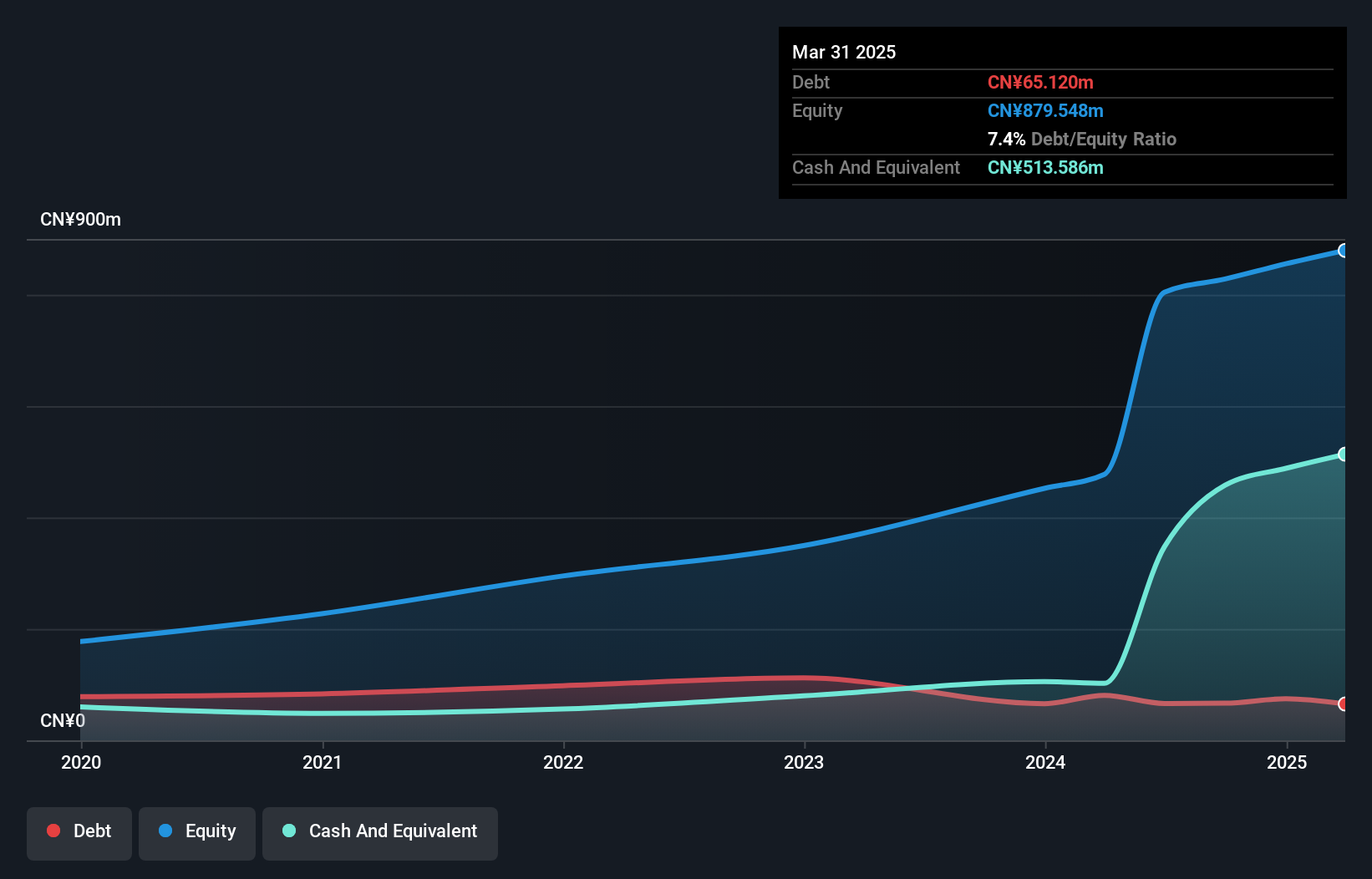

Reach Machinery's recent performance highlights its position as a promising player in the machinery industry. Earnings grew by 9% over the past year, significantly outpacing the industry's -1% decline. The company's debt is well-managed, with EBIT covering interest payments 533 times over. Despite a volatile share price recently, Reach Machinery remains profitable, with free cash flow positive at CNY 66 million as of September 2024. Recent earnings reports show sales increased to CNY 442 million for nine months ending September compared to last year's CNY 428 million, while net income rose slightly to CNY 73 million from CNY 70 million.

- Get an in-depth perspective on Reach Machinery's performance by reading our health report here.

Gain insights into Reach Machinery's past trends and performance with our Past report.

Summing It All Up

- Explore the 4730 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techno Electric & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TECHNOE

Techno Electric & Engineering

Provides engineering, procurement, and construction (EPC) services to the power generation, transmission, and distribution sectors in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives