Why Investors Shouldn't Be Surprised By Synergy Green Industries Limited's (NSE:SGIL) 29% Share Price Surge

Synergy Green Industries Limited (NSE:SGIL) shares have had a really impressive month, gaining 29% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 69%.

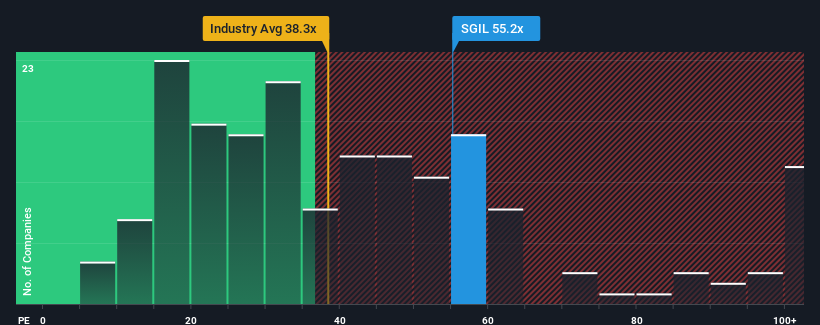

After such a large jump in price, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider Synergy Green Industries as a stock to avoid entirely with its 55.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been quite advantageous for Synergy Green Industries as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Synergy Green Industries

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Synergy Green Industries' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 54% gain to the company's bottom line. Pleasingly, EPS has also lifted 125% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Synergy Green Industries is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got Synergy Green Industries' P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Synergy Green Industries revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Synergy Green Industries (1 is significant) you should be aware of.

Of course, you might also be able to find a better stock than Synergy Green Industries. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Synergy Green Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SGIL

Synergy Green Industries

Manufactures and sells wind turbine casting and other large precision castings in India.

Proven track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives