- India

- /

- Construction

- /

- NSEI:SALASAR

If You Had Bought Salasar Techno Engineering (NSE:SALASAR) Stock A Year Ago, You'd Be Sitting On A 49% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Salasar Techno Engineering Limited (NSE:SALASAR) share price slid 49% over twelve months. That falls noticeably short of the market return of around -3.8%. Salasar Techno Engineering hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The falls have accelerated recently, with the share price down 28% in the last three months.

See our latest analysis for Salasar Techno Engineering

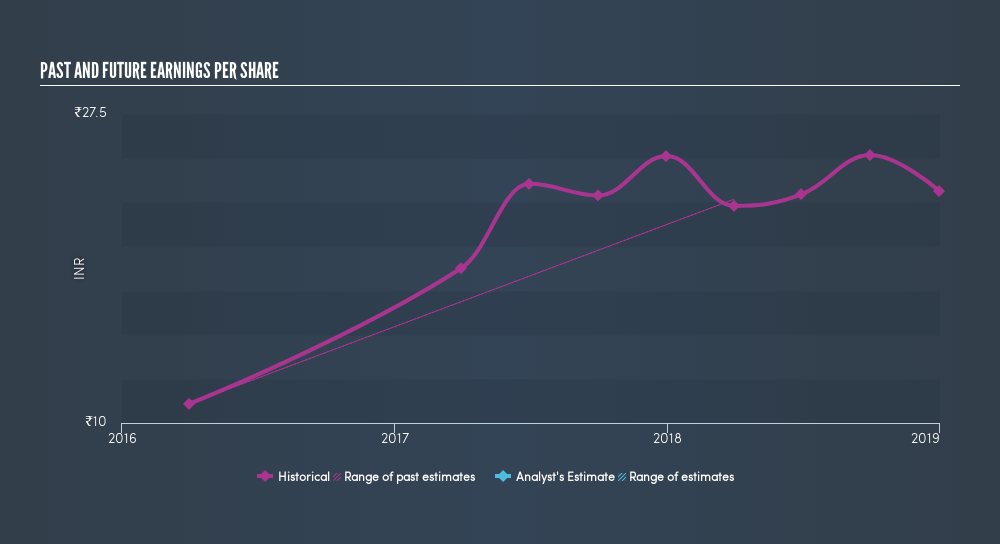

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unhappily, Salasar Techno Engineering had to report a 7.9% decline in EPS over the last year. The share price decline of 49% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business. The P/E ratio of 8.54 also points to the negative market sentiment.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Salasar Techno Engineering's key metrics by checking this interactive graph of Salasar Techno Engineering's earnings, revenue and cash flow.

A Different Perspective

Salasar Techno Engineering shareholders are down 48% for the year (even including dividends), even worse than the market loss of 3.8%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 28% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Before deciding if you like the current share price, check how Salasar Techno Engineering scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges. We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:SALASAR

Salasar Techno Engineering

Engages in the manufacture and sale of galvanized and non-galvanized steel structures in India and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives