We Ran A Stock Scan For Earnings Growth And Orient Bell (NSE:ORIENTBELL) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Orient Bell (NSE:ORIENTBELL), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Orient Bell with the means to add long-term value to shareholders.

View our latest analysis for Orient Bell

How Fast Is Orient Bell Growing Its Earnings Per Share?

In the last three years Orient Bell's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, Orient Bell's EPS shot from ₹13.46 to ₹28.79, over the last year. It's a rarity to see 114% year-on-year growth like that.

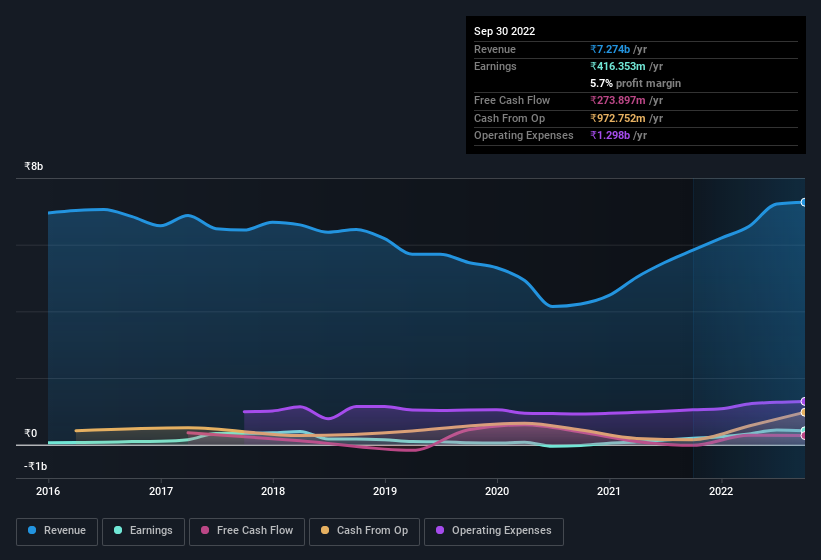

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Orient Bell shareholders can take confidence from the fact that EBIT margins are up from 4.6% to 6.8%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Orient Bell isn't a huge company, given its market capitalisation of ₹7.1b. That makes it extra important to check on its balance sheet strength.

Are Orient Bell Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Orient Bell insiders spent ₹15m on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Executive Chairman Mahendra Daga for ₹2.0m worth of shares, at about ₹513 per share.

On top of the insider buying, we can also see that Orient Bell insiders own a large chunk of the company. In fact, they own 42% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. To give you an idea, the value of insiders' holdings in the business are valued at ₹3.0b at the current share price. So there's plenty there to keep them focused!

Does Orient Bell Deserve A Spot On Your Watchlist?

Orient Bell's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Orient Bell deserves timely attention. We should say that we've discovered 1 warning sign for Orient Bell that you should be aware of before investing here.

The good news is that Orient Bell is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ORIENTBELL

Orient Bell

Manufactures, trades in, and sells ceramic and floor tiles in India and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives