- India

- /

- Construction

- /

- NSEI:NILAINFRA

Nila Infrastructures Limited's (NSE:NILAINFRA) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Nila Infrastructures (NSE:NILAINFRA) has had a great run on the share market with its stock up by a significant 58% over the last three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Particularly, we will be paying attention to Nila Infrastructures' ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Nila Infrastructures

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Nila Infrastructures is:

6.3% = ₹86m ÷ ₹1.4b (Based on the trailing twelve months to June 2020).

The 'return' is the profit over the last twelve months. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.06 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Nila Infrastructures' Earnings Growth And 6.3% ROE

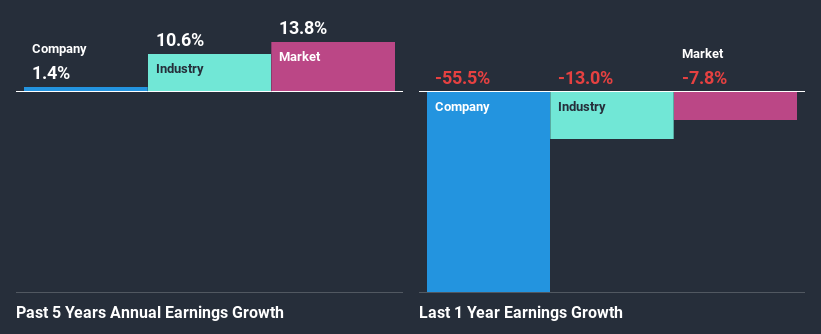

It is quite clear that Nila Infrastructures' ROE is rather low. A comparison with the industry shows that the company's ROE is pretty similar to the average industry ROE of 6.9%. Nila Infrastructures' flat earnings over the past five years can possibly be explained by the low ROE amongst other factors.

As a next step, we compared Nila Infrastructures' net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 11% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Nila Infrastructures is trading on a high P/E or a low P/E, relative to its industry.

Is Nila Infrastructures Making Efficient Use Of Its Profits?

Nila Infrastructures' low three-year median payout ratio of 22%, (meaning the company retains78% of profits) should mean that the company is retaining most of its earnings and consequently, should see higher growth than it has reported.

Summary

On the whole, we feel that the performance shown by Nila Infrastructures can be open to many interpretations. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Nila Infrastructures' past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you’re looking to trade Nila Infrastructures, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nila Infrastructures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:NILAINFRA

Nila Infrastructures

Nila Infrastructures Limited constructs and develops infrastructure and real estate projects in India.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)