- India

- /

- Aerospace & Defense

- /

- NSEI:MAZDOCK

Mazagon Dock Shipbuilders Limited (NSE:MAZDOCK) Looks Just Right With A 44% Price Jump

Mazagon Dock Shipbuilders Limited (NSE:MAZDOCK) shares have continued their recent momentum with a 44% gain in the last month alone. The last month tops off a massive increase of 205% in the last year.

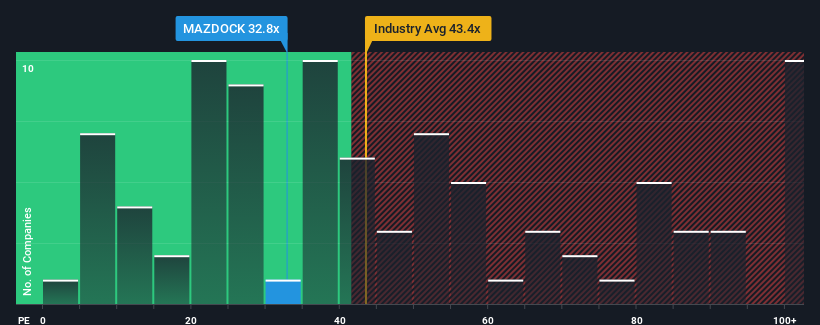

In spite of the firm bounce in price, it's still not a stretch to say that Mazagon Dock Shipbuilders' price-to-earnings (or "P/E") ratio of 32.8x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 31x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Mazagon Dock Shipbuilders has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Mazagon Dock Shipbuilders

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Mazagon Dock Shipbuilders' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 73% last year. Pleasingly, EPS has also lifted 277% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 24% during the coming year according to the two analysts following the company. Meanwhile, the rest of the market is forecast to expand by 25%, which is not materially different.

In light of this, it's understandable that Mazagon Dock Shipbuilders' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Mazagon Dock Shipbuilders' P/E

Its shares have lifted substantially and now Mazagon Dock Shipbuilders' P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Mazagon Dock Shipbuilders' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

You need to take note of risks, for example - Mazagon Dock Shipbuilders has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If these risks are making you reconsider your opinion on Mazagon Dock Shipbuilders, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAZDOCK

Mazagon Dock Shipbuilders

Engages in building and repairing of ships, submarines, vessels, and related engineering products in India and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives