- India

- /

- Trade Distributors

- /

- NSEI:LLOYDSENT

Lloyds Enterprises' (NSE:LLOYDSENT) Profits May Not Reveal Underlying Issues

The recent earnings posted by Lloyds Enterprises Limited (NSE:LLOYDSENT) were solid, but the stock didn't move as much as we expected. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

Check out our latest analysis for Lloyds Enterprises

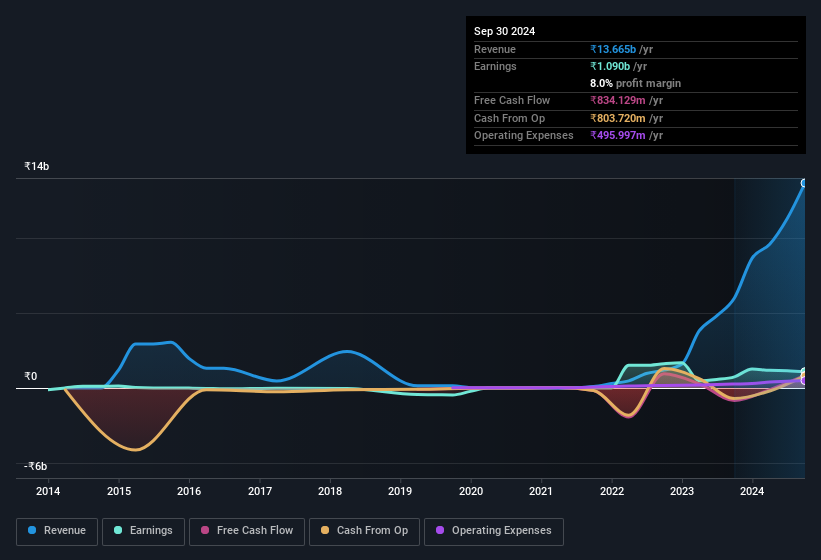

The Impact Of Unusual Items On Profit

To properly understand Lloyds Enterprises' profit results, we need to consider the ₹1.1b gain attributed to unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. Lloyds Enterprises had a rather significant contribution from unusual items relative to its profit to September 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Lloyds Enterprises.

Our Take On Lloyds Enterprises' Profit Performance

As we discussed above, we think the significant positive unusual item makes Lloyds Enterprises' earnings a poor guide to its underlying profitability. For this reason, we think that Lloyds Enterprises' statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For instance, we've identified 3 warning signs for Lloyds Enterprises (1 is a bit concerning) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Lloyds Enterprises' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

If you're looking to trade Lloyds Enterprises, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LLOYDSENT

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives