Why We're Not Concerned About Lloyds Engineering Works Limited's (NSE:LLOYDSENGG) Share Price

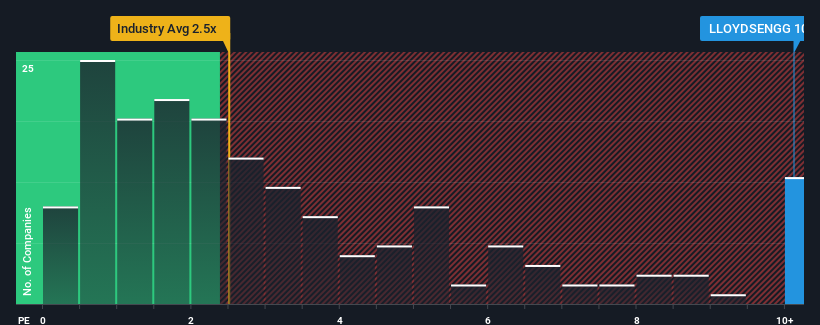

Lloyds Engineering Works Limited's (NSE:LLOYDSENGG) price-to-sales (or "P/S") ratio of 10.1x may look like a poor investment opportunity when you consider close to half the companies in the Machinery industry in India have P/S ratios below 2.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Lloyds Engineering Works

How Lloyds Engineering Works Has Been Performing

Recent times have been quite advantageous for Lloyds Engineering Works as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Lloyds Engineering Works will help you shine a light on its historical performance.How Is Lloyds Engineering Works' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Lloyds Engineering Works' to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 13% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Lloyds Engineering Works' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Lloyds Engineering Works revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Lloyds Engineering Works (1 is a bit concerning!) that we have uncovered.

If you're unsure about the strength of Lloyds Engineering Works' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LLOYDSENGG

Lloyds Engineering Works

Provides engineering products and services in India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives