Why Investors Shouldn't Be Surprised By Lloyds Engineering Works Limited's (NSE:LLOYDSENGG) 27% Share Price Surge

Lloyds Engineering Works Limited (NSE:LLOYDSENGG) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last month tops off a massive increase of 172% in the last year.

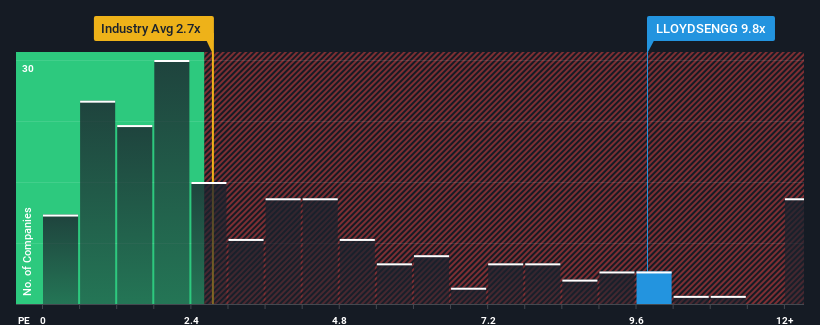

After such a large jump in price, given around half the companies in India's Machinery industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider Lloyds Engineering Works as a stock to avoid entirely with its 9.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Lloyds Engineering Works

What Does Lloyds Engineering Works' Recent Performance Look Like?

Lloyds Engineering Works certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Lloyds Engineering Works will help you shine a light on its historical performance.How Is Lloyds Engineering Works' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Lloyds Engineering Works' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 12%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Lloyds Engineering Works' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Lloyds Engineering Works' P/S

The strong share price surge has lead to Lloyds Engineering Works' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Lloyds Engineering Works can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Lloyds Engineering Works, and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LLOYDSENGG

Lloyds Engineering Works

Provides engineering products and services in India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives