The Indian market has shown impressive performance, rising 1.2% over the last week and 41% over the past year, with earnings forecasted to grow by 17% annually. In this thriving environment, growth companies with significant insider ownership can be particularly attractive due to the confidence and alignment of interests they demonstrate from those within the company.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| KEI Industries (BSE:517569) | 18.7% | 22.4% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Here we highlight a subset of our preferred stocks from the screener.

Awfis Space Solutions (NSEI:AWFIS)

Simply Wall St Growth Rating: ★★★★★☆

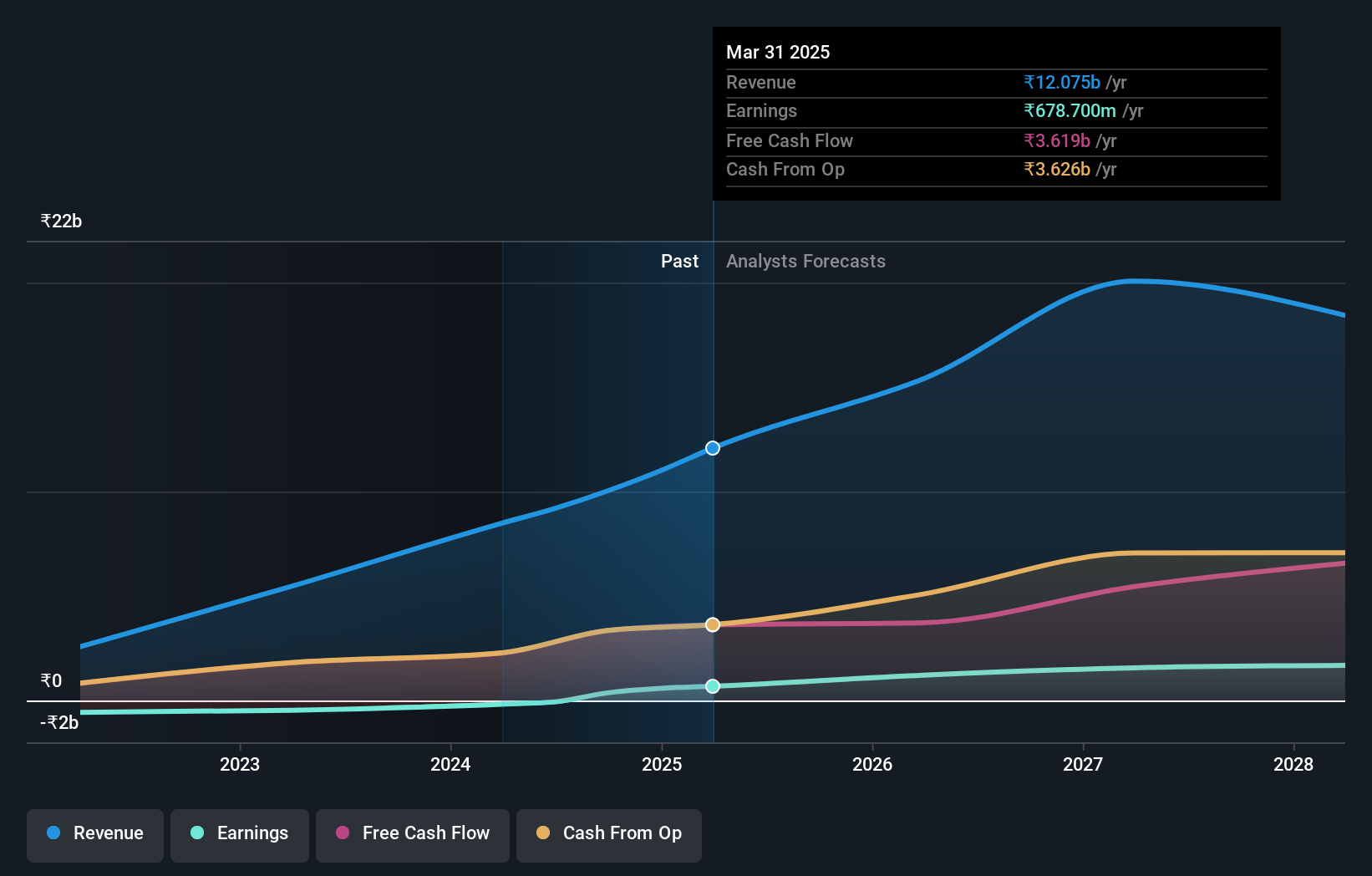

Overview: Awfis Space Solutions Limited provides flexible workspace solutions in India and has a market cap of ₹50.07 billion.

Operations: Awfis Space Solutions Limited generates revenue primarily from Co-Working Space on Rent and Allied Services (₹6.65 billion) and Construction and Fit-Out Projects (₹2.29 billion).

Insider Ownership: 25.4%

Awfis Space Solutions is forecast to grow earnings by 72.41% annually and become profitable within three years, outpacing the Indian market's average growth. Despite high revenue growth (25.6% per year), the company has experienced significant insider selling and a highly volatile share price over the past three months. Recent expansions include a new center in GIFT City, Gandhinagar, and partnerships in Pune, enhancing its premium flexible workspace offerings across India’s key business hubs.

- Click here and access our complete growth analysis report to understand the dynamics of Awfis Space Solutions.

- Our expertly prepared valuation report Awfis Space Solutions implies its share price may be too high.

Kirloskar Oil Engines (NSEI:KIRLOSENG)

Simply Wall St Growth Rating: ★★★★☆☆

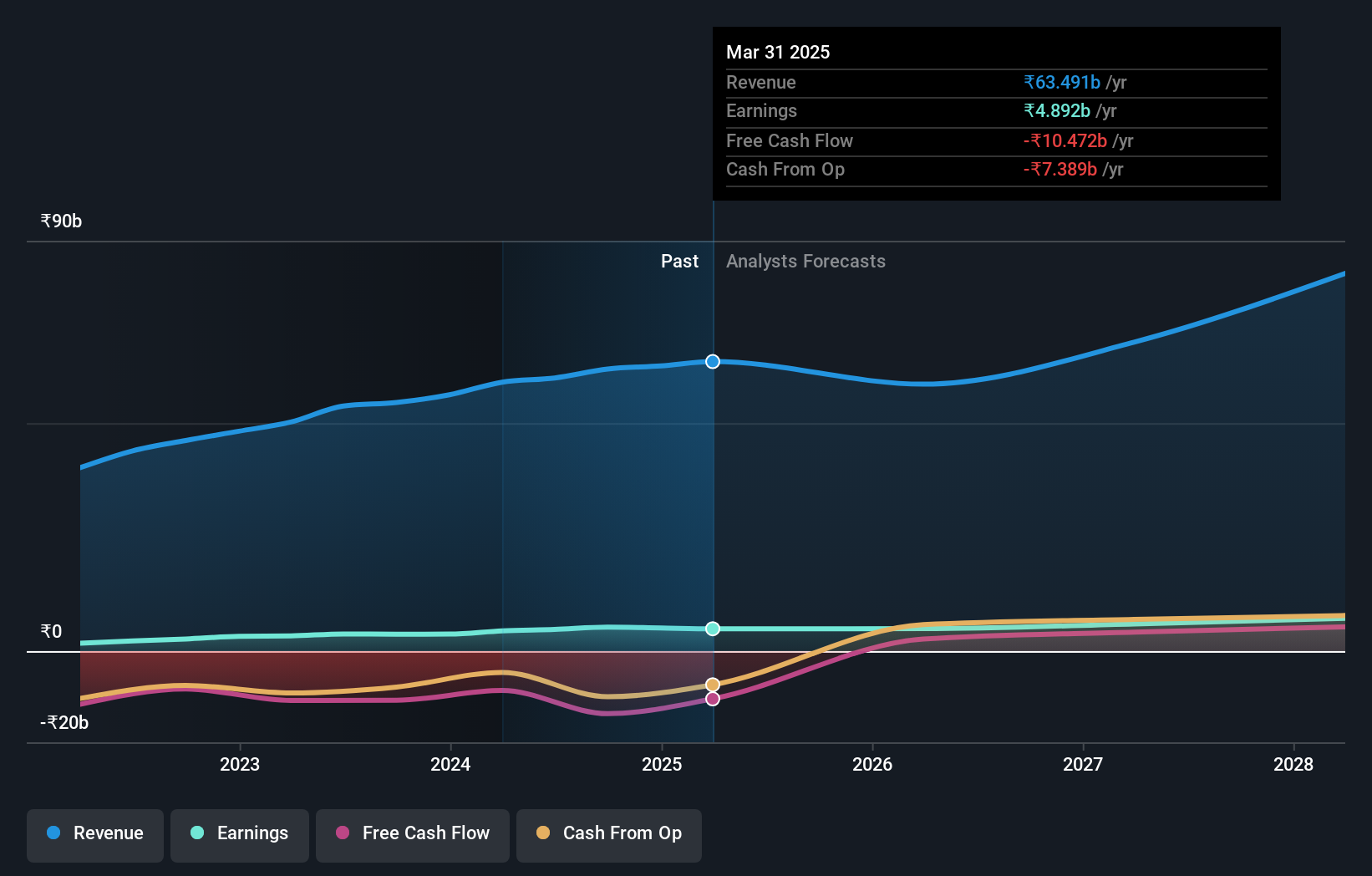

Overview: Kirloskar Oil Engines Limited manufactures and distributes diesel engines, agricultural pump sets, electric pump sets, power tillers, generating sets, and spares in India and internationally with a market cap of ₹185.31 billion.

Operations: The company's revenue segments are B2B (₹42.78 billion), B2C (₹11.13 billion), and Financial Services (₹5.99 billion).

Insider Ownership: 23.2%

Kirloskar Oil Engines is poised for growth with earnings forecasted to increase by 19% annually, outpacing the Indian market. The company reported strong Q1 results with net income rising to ₹1.59 billion. Recent strategic moves include a planned capacity expansion at its Kolhapur plant and seeking inorganic growth opportunities, supported by a robust balance sheet. Insider ownership remains high, reflecting confidence in the company's long-term prospects despite modest dividend coverage and interest payment concerns.

- Unlock comprehensive insights into our analysis of Kirloskar Oil Engines stock in this growth report.

- Our expertly prepared valuation report Kirloskar Oil Engines implies its share price may be lower than expected.

R Systems International (NSEI:RSYSTEMS)

Simply Wall St Growth Rating: ★★★★☆☆

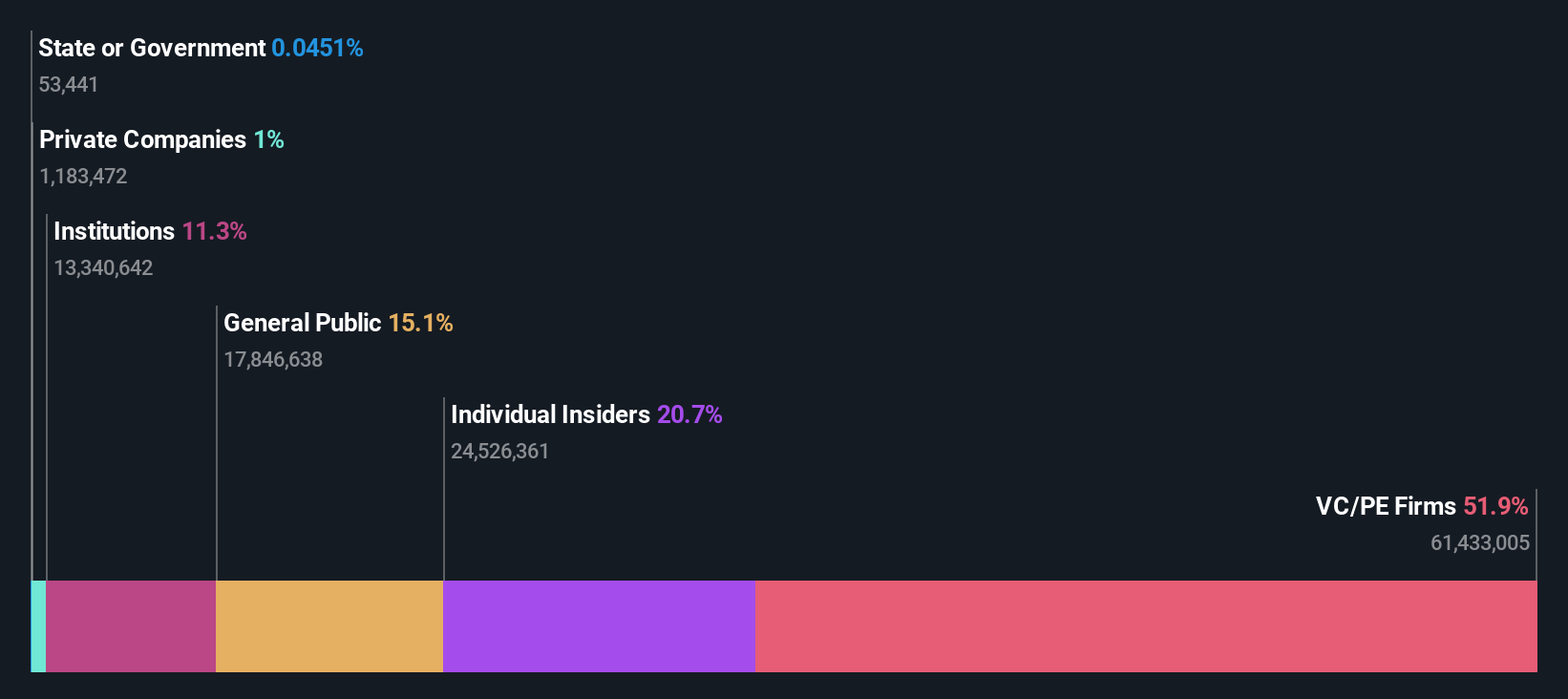

Overview: R Systems International Limited, a digital product engineering company that designs and builds chip-to-cloud software products and platforms, has a market cap of ₹60.55 billion.

Operations: R Systems International Limited generates revenue primarily from Information Technology Services, amounting to ₹15.53 billion, and Business Process Outsourcing Services, which contribute ₹1.76 billion.

Insider Ownership: 29.0%

R Systems International is positioned for growth with earnings projected to increase by 19.08% per year, surpassing the Indian market's average. Recent developments include the launch of OptimaAI Suite, aimed at enhancing enterprise AI adoption and driving revenue growth. The company reported strong Q2 results, with net income rising to ₹248.83 million from ₹144.25 million a year ago, reflecting robust operational performance despite an unstable dividend track record. Insider ownership remains substantial, indicating confidence in long-term prospects.

- Click here to discover the nuances of R Systems International with our detailed analytical future growth report.

- Our valuation report unveils the possibility R Systems International's shares may be trading at a premium.

Taking Advantage

- Unlock our comprehensive list of 92 Fast Growing Indian Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade R Systems International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RSYSTEMS

R Systems International

A digital product engineering company, designs and builds chip-to-cloud software products and platforms.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives