Why Investors Shouldn't Be Surprised By Jupiter Wagons Limited's (NSE:JWL) 37% Share Price Surge

Jupiter Wagons Limited (NSE:JWL) shares have continued their recent momentum with a 37% gain in the last month alone. The annual gain comes to 300% following the latest surge, making investors sit up and take notice.

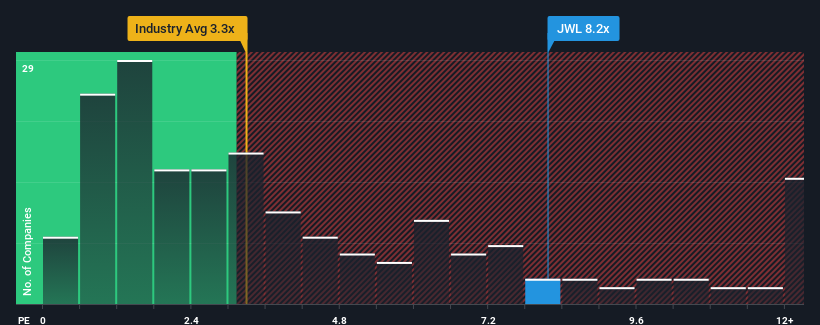

After such a large jump in price, when almost half of the companies in India's Machinery industry have price-to-sales ratios (or "P/S") below 3.3x, you may consider Jupiter Wagons as a stock not worth researching with its 8.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Jupiter Wagons

What Does Jupiter Wagons' P/S Mean For Shareholders?

Recent times have been advantageous for Jupiter Wagons as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Jupiter Wagons' future stacks up against the industry? In that case, our free report is a great place to start.How Is Jupiter Wagons' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jupiter Wagons' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 76% last year. Pleasingly, revenue has also lifted 266% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 25% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 15% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Jupiter Wagons' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Jupiter Wagons' P/S?

Shares in Jupiter Wagons have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Jupiter Wagons' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Jupiter Wagons (2 are a bit unpleasant!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Jupiter Wagons, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JWL

Jupiter Wagons

Manufactures and sells railway wagons, wagon components, and railway transportation equipment in India and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives