Over the last 7 days, the Indian market has risen 1.8%, driven by gains of 2.2% in the Financials sector, and is up 46% over the last 12 months with earnings forecast to grow by 17% annually. In this favorable environment, growth companies with high insider ownership stand out as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 35% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 21.8% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.6% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| KEI Industries (BSE:517569) | 19.1% | 22.4% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Let's uncover some gems from our specialized screener.

Intellect Design Arena (NSEI:INTELLECT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intellect Design Arena Limited develops software and offers related services for banking, insurance, and financial sectors both in India and globally, with a market cap of ₹135.76 billion.

Operations: The company's revenue primarily comes from Software Product License & Related Services, amounting to ₹24.73 billion.

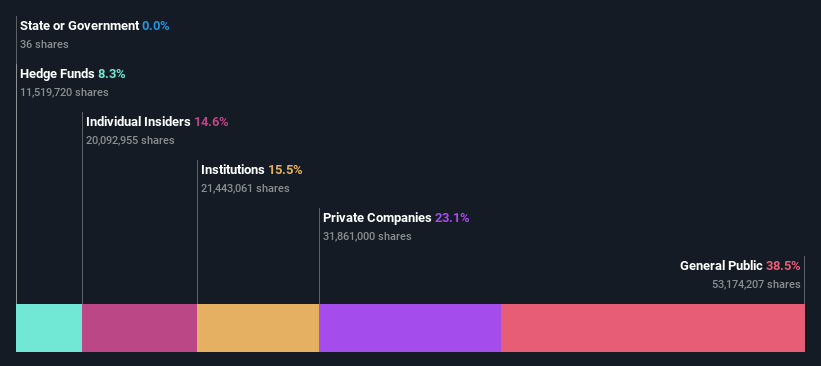

Insider Ownership: 14.6%

Intellect Design Arena's revenue is forecast to grow at 11.1% per year, outpacing the Indian market's 10%. Earnings are expected to rise significantly at 22.4% annually over the next three years. Despite a low projected Return on Equity of 17.7%, insider buying has been positive in recent months. Recent strategic moves include opening a Global Partnership Office in Bengaluru and launching innovative AI platforms like Purple Fabric, enhancing its position in financial technology solutions.

- Click to explore a detailed breakdown of our findings in Intellect Design Arena's earnings growth report.

- The valuation report we've compiled suggests that Intellect Design Arena's current price could be inflated.

JNK India (NSEI:JNKINDIA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JNK India Limited is a heating equipment company that designs, engineers, manufactures, supplies, installs, and commissions process fired heaters, reformers, and cracking furnaces in India and internationally with a market cap of ₹42.64 billion.

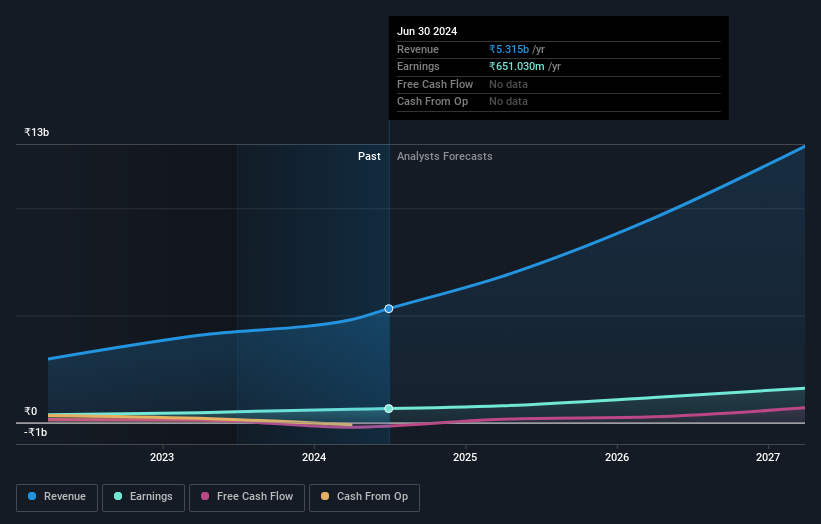

Operations: The company's revenue primarily comes from Fired Heaters and Related Products, amounting to ₹5.32 billion.

Insider Ownership: 21%

JNK India has demonstrated strong growth, with earnings rising 29.1% last year and forecasted to grow 33.71% annually. Recent significant orders from Mundra Petrochem, JNK Global, and Reliance Industries bolster its revenue prospects, expected to increase by 32% per year—outpacing the Indian market's growth rate. Despite a highly volatile share price recently, the company's substantial insider ownership aligns management interests with shareholders' goals, enhancing long-term growth potential.

- Delve into the full analysis future growth report here for a deeper understanding of JNK India.

- Our valuation report here indicates JNK India may be overvalued.

Varun Beverages (NSEI:VBL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited, with a market cap of ₹2.05 trillion, operates as the franchisee for PepsiCo's carbonated soft drinks and non-carbonated beverages.

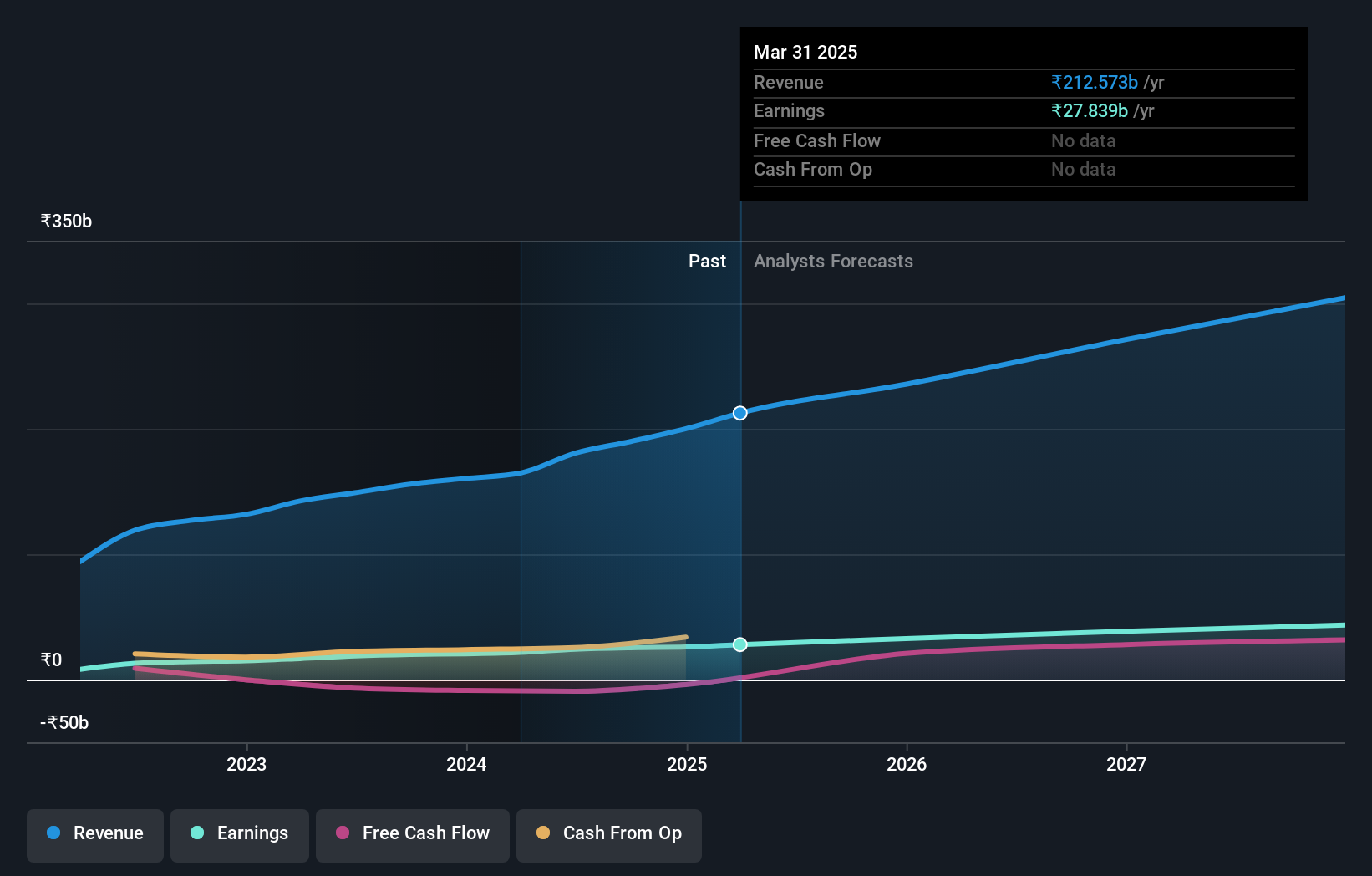

Operations: Revenue from the manufacturing and sale of beverages amounts to ₹180.52 billion.

Insider Ownership: 36.3%

Varun Beverages has shown solid growth, with earnings up 29% over the past year and forecasted to grow at 22.27% annually, outpacing the Indian market. Recent revenue growth to ₹73.78 billion for Q2 2024 underscores its strong performance. The company's high insider ownership aligns management interests with shareholders, enhancing trust. However, it carries a significant debt load which investors should monitor closely amidst its expansion plans and recent dividend affirmations of ₹1.25 per share.

- Navigate through the intricacies of Varun Beverages with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Varun Beverages implies its share price may be too high.

Turning Ideas Into Actions

- Delve into our full catalog of 92 Fast Growing Indian Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:INTELLECT

Intellect Design Arena

Provides software development and related services for banking, insurance, and other financial services in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives