Here's Why Hercules Hoists (NSE:HERCULES) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Hercules Hoists (NSE:HERCULES), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Hercules Hoists

Hercules Hoists' Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Hercules Hoists grew its EPS from ₹4.89 to ₹33.60, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

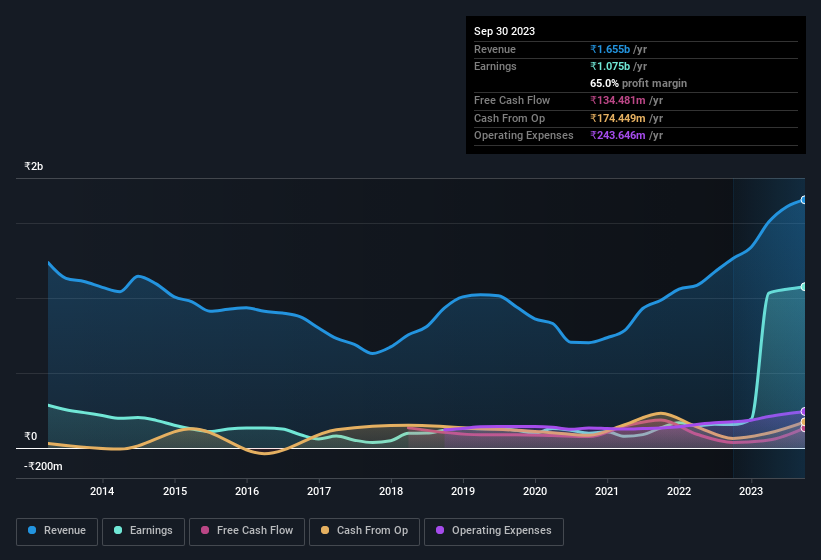

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Hercules Hoists shareholders is that EBIT margins have grown from 4.7% to 9.1% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Hercules Hoists isn't a huge company, given its market capitalisation of ₹13b. That makes it extra important to check on its balance sheet strength.

Are Hercules Hoists Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Hercules Hoists followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at ₹3.0b. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 23% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add Hercules Hoists To Your Watchlist?

Hercules Hoists' earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Hercules Hoists very closely. We don't want to rain on the parade too much, but we did also find 2 warning signs for Hercules Hoists that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hercules Hoists might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HERCULES

Hercules Hoists

Operates as an unregistered core investment company in India.

Excellent balance sheet with low risk.

Market Insights

Community Narratives