- India

- /

- Trade Distributors

- /

- NSEI:HARDWYN

With EPS Growth And More, Hardwyn India (NSE:HARDWYN) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hardwyn India (NSE:HARDWYN). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Hardwyn India

How Fast Is Hardwyn India Growing Its Earnings Per Share?

Hardwyn India has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Hardwyn India's EPS skyrocketed from ₹0.17 to ₹0.27, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 59%.

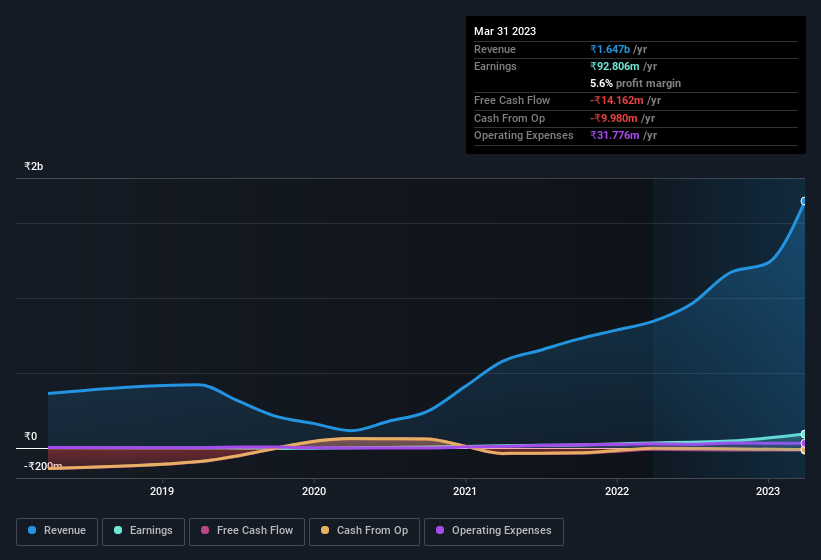

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Hardwyn India shareholders can take confidence from the fact that EBIT margins are up from 5.9% to 8.1%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Hardwyn India is no giant, with a market capitalisation of ₹14b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Hardwyn India Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The real kicker here is that Hardwyn India insiders spent a staggering ₹2.0b on acquiring shares in just one year, without single share being sold in the meantime. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was company insider Ginni Chadha who made the biggest single purchase, worth ₹1.6b, paying ₹24.03 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Hardwyn India insiders own more than a third of the company. Indeed, with a collective holding of 91%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at ₹12b at the current share price. So there's plenty there to keep them focused!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Rubaljeet Sayal is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between ₹8.2b and ₹33b, like Hardwyn India, the median CEO pay is around ₹16m.

The Hardwyn India CEO received total compensation of only ₹600k in the year to March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Hardwyn India Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Hardwyn India's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. You still need to take note of risks, for example - Hardwyn India has 2 warning signs we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Hardwyn India isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hardwyn India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HARDWYN

Hardwyn India

Manufactures and trades in architectural hardware and glass fittings to residential and commercial structures under the Hardwyn brand in India.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives