Indian Exchange Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 4.7%, yet it remains up by an impressive 39% over the past year, with earnings expected to grow by 17% annually in the coming years. In this context of fluctuating short-term performance and promising long-term prospects, growth companies with high insider ownership can offer potential stability and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.3% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Sunteck Realty (BSE:512179) | 14.8% | 40.7% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.1% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.8% |

Let's dive into some prime choices out of the screener.

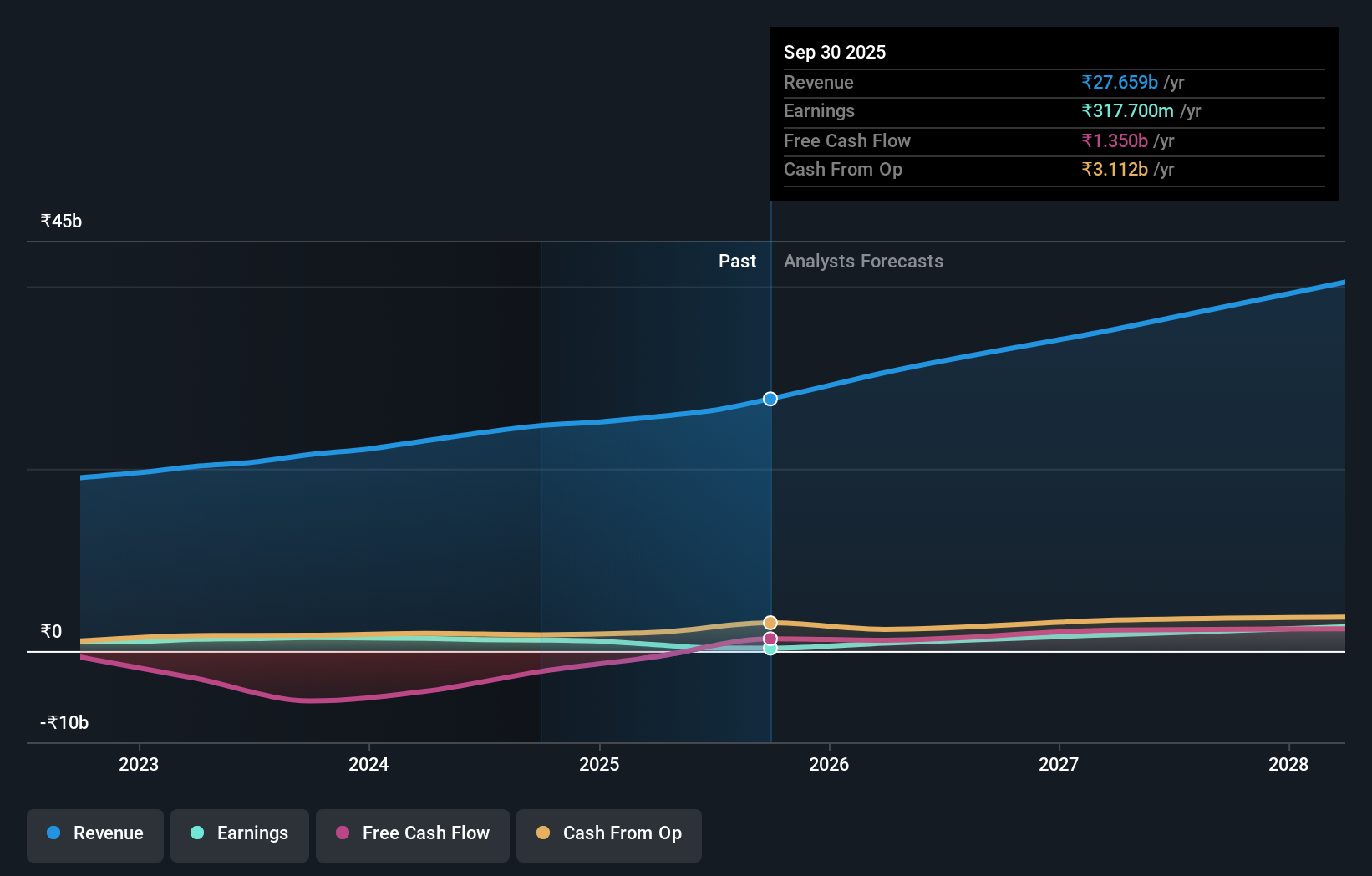

Greenlam Industries (NSEI:GREENLAM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Greenlam Industries Limited manufactures and sells laminates, decorative veneers, and allied products both in India and internationally, with a market cap of ₹64.90 billion.

Operations: The company's revenue segments are comprised of ₹21.02 billion from Laminate & Allied Products, ₹2.09 billion from Veneers & Allied Products, and ₹847.70 million from Plywood & Allied Products.

Insider Ownership: 24.6%

Earnings Growth Forecast: 33.7% p.a.

Greenlam Industries demonstrates potential as a growth company with substantial insider ownership in India. Despite a recent dip in net income to INR 202.7 million, its revenue is forecasted to grow at 19.1% annually, outpacing the Indian market average of 10%. Earnings are expected to rise significantly by 33.7% per year over the next three years. However, concerns remain about its low return on equity and debt coverage from operating cash flow. Recent board meetings focused on restructuring non-convertible debentures may indicate strategic financial adjustments underway.

- Navigate through the intricacies of Greenlam Industries with our comprehensive analyst estimates report here.

- Our valuation report here indicates Greenlam Industries may be overvalued.

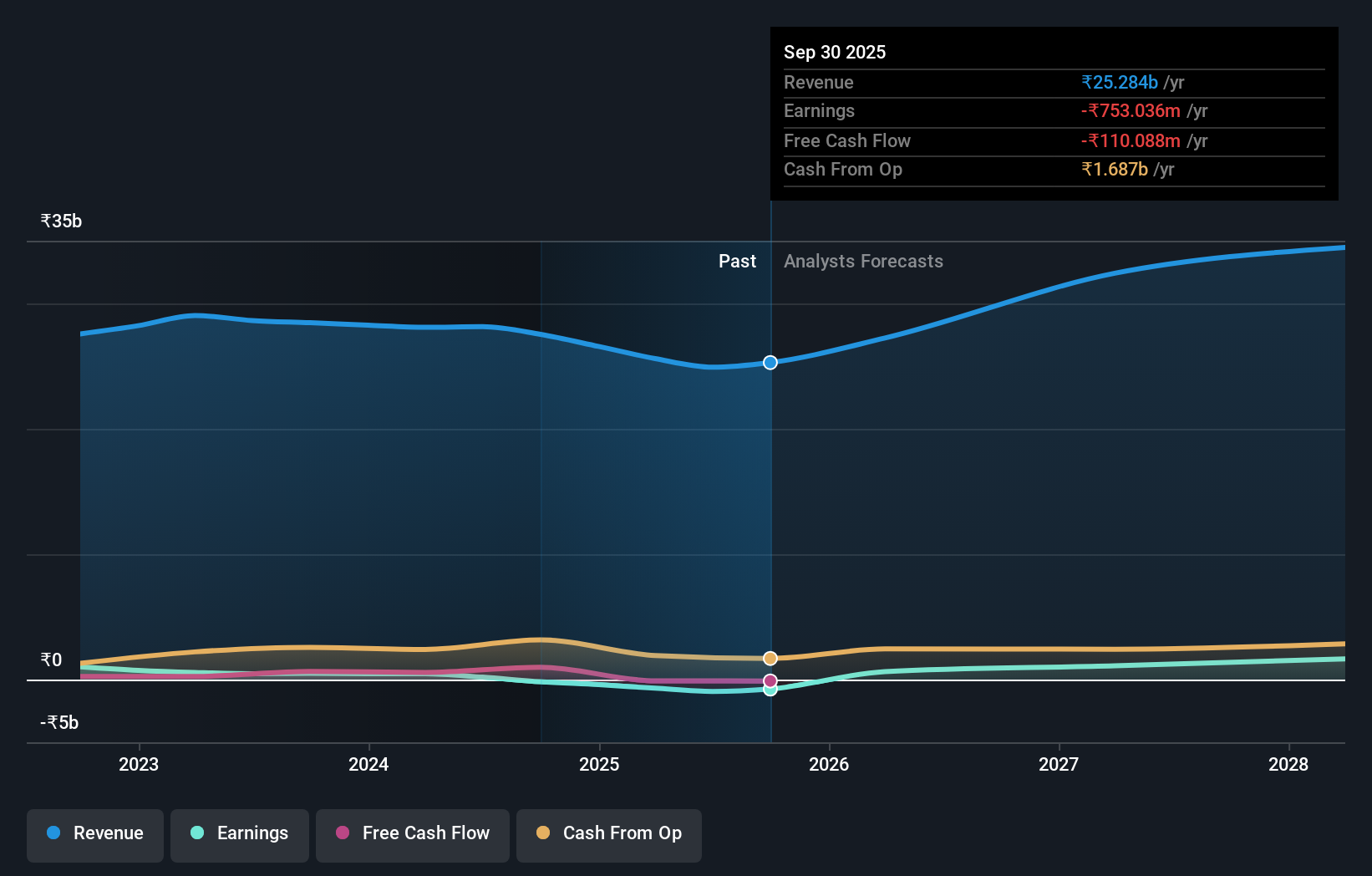

Hindware Home Innovation (NSEI:HINDWAREAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hindware Home Innovation Limited operates in India, focusing on manufacturing, selling and trading building products and consumer appliances, with a market cap of ₹21.34 billion.

Operations: The company's revenue is primarily derived from its building products segment at ₹23.56 billion, followed by the consumer appliances business at ₹4.39 billion and the retail business contributing ₹121.54 million.

Insider Ownership: 13.7%

Earnings Growth Forecast: 58.6% p.a.

Hindware Home Innovation shows potential for growth with high insider ownership, despite challenges. Its earnings are expected to grow significantly at 58.6% annually, outpacing the Indian market's 17.2%. However, its return on equity is forecasted to remain low at 18.7%, and recent enforcement actions under GST and consumer protection laws may impact financials. A follow-on equity offering indicates efforts to strengthen capital structure amid these regulatory challenges and declining profit margins from last year’s figures.

- Click here and access our complete growth analysis report to understand the dynamics of Hindware Home Innovation.

- Insights from our recent valuation report point to the potential overvaluation of Hindware Home Innovation shares in the market.

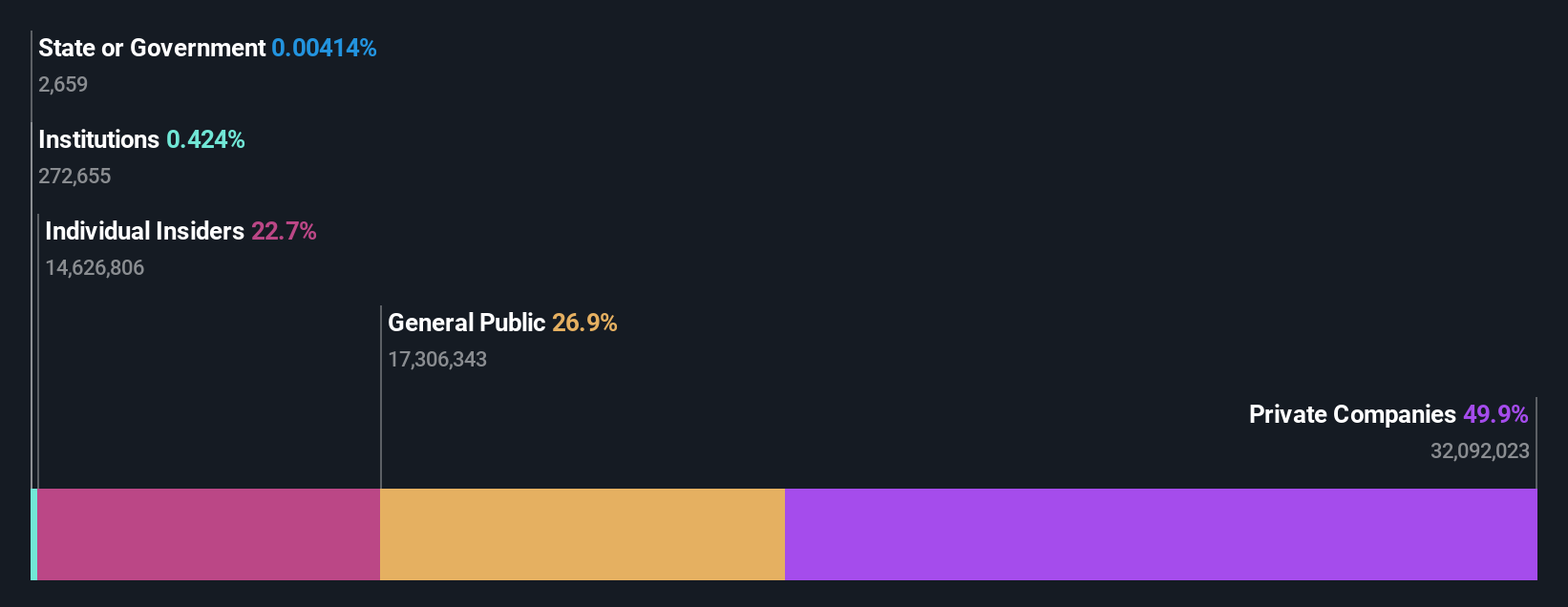

HPL Electric & Power (NSEI:HPL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HPL Electric & Power Limited manufactures and sells electric equipment under the HPL brand in India, with a market cap of ₹35.94 billion.

Operations: The company's revenue is primarily derived from two segments: Metering, Systems & Services, which contributes ₹9.15 billion, and Consumer, Industrial & Services, accounting for ₹6.18 billion.

Insider Ownership: 22.7%

Earnings Growth Forecast: 44.8% p.a.

HPL Electric & Power is experiencing significant growth, with earnings projected to increase by 44.8% annually, surpassing the Indian market's average of 17.2%. Revenue is also expected to grow at 23.5% per year. Despite high volatility in its share price and insufficient data on return on equity forecasts, recent inclusion in the S&P Global BMI Index and substantial new orders for smart meters highlight its expanding market presence, although interest coverage remains a concern.

- Delve into the full analysis future growth report here for a deeper understanding of HPL Electric & Power.

- In light of our recent valuation report, it seems possible that HPL Electric & Power is trading beyond its estimated value.

Taking Advantage

- Discover the full array of 91 Fast Growing Indian Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Greenlam Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GREENLAM

Greenlam Industries

Manufactures and sells laminates, decorative veneers, and their allied products in India and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives