- India

- /

- Trade Distributors

- /

- NSEI:ESSENTIA

Integra Essentia Limited (NSE:ESSENTIA) Stock Rockets 34% As Investors Are Less Pessimistic Than Expected

Integra Essentia Limited (NSE:ESSENTIA) shareholders have had their patience rewarded with a 34% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 29%.

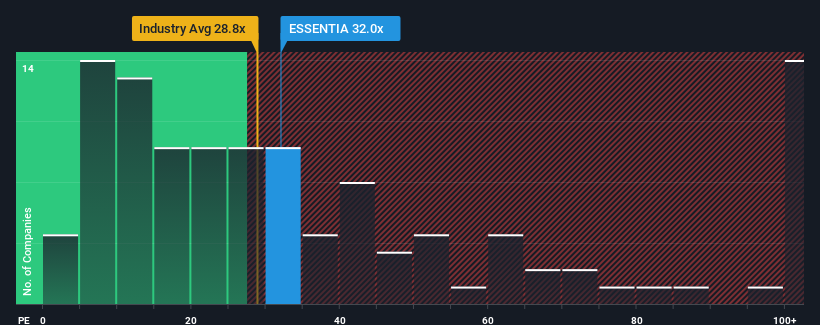

Although its price has surged higher, you could still be forgiven for feeling indifferent about Integra Essentia's P/E ratio of 32x, since the median price-to-earnings (or "P/E") ratio in India is also close to 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's exceedingly strong of late, Integra Essentia has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Integra Essentia

How Is Integra Essentia's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Integra Essentia's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 72% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Integra Essentia is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Its shares have lifted substantially and now Integra Essentia's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Integra Essentia currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Integra Essentia (1 is a bit unpleasant!) that you need to be mindful of.

You might be able to find a better investment than Integra Essentia. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ESSENTIA

Integra Essentia

Trades in agricultural commodities, life necessities, items of basic human needs, organic and natural products, processed food, and infrastructural products in India.

Excellent balance sheet low.

Market Insights

Community Narratives