Diffusion Engineers Limited (NSE:DIFFNKG) Senior Key Executive Prashant Garg, the company's largest shareholder sees 11%reduction in holdings value

Key Insights

- Significant insider control over Diffusion Engineers implies vested interests in company growth

- The largest shareholder of the company is Prashant Garg with a 53% stake

- 11% of Diffusion Engineers is held by Institutions

A look at the shareholders of Diffusion Engineers Limited (NSE:DIFFNKG) can tell us which group is most powerful. With 74% stake, individual insiders possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

And following last week's 11% decline in share price, insiders suffered the most losses.

In the chart below, we zoom in on the different ownership groups of Diffusion Engineers.

See our latest analysis for Diffusion Engineers

What Does The Institutional Ownership Tell Us About Diffusion Engineers?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

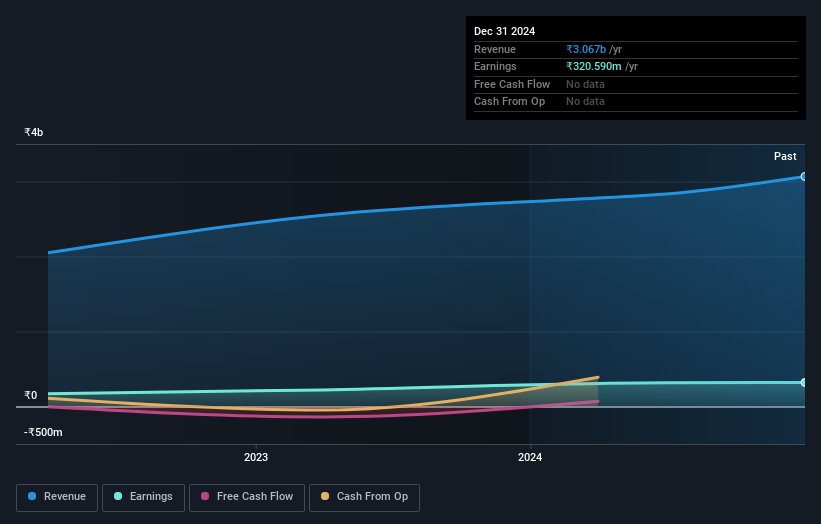

We can see that Diffusion Engineers does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Diffusion Engineers' earnings history below. Of course, the future is what really matters.

Diffusion Engineers is not owned by hedge funds. Because actions speak louder than words, we consider it a good sign when insiders own a significant stake in a company. In Diffusion Engineers' case, its Senior Key Executive, Prashant Garg, is the largest shareholder, holding 53% of shares outstanding. For context, the second largest shareholder holds about 16% of the shares outstanding, followed by an ownership of 5.3% by the third-largest shareholder.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. As far as we can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Diffusion Engineers

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own the majority of Diffusion Engineers Limited. This means they can collectively make decisions for the company. That means they own ₹6.7b worth of shares in the ₹9.0b company. That's quite meaningful. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 15% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I always like to check for a history of revenue growth. You can too, by accessing this free chart of historic revenue and earnings in this detailed graph.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DIFFNKG

Diffusion Engineers

Manufactures and sells welding consumables, wear plates and parts, and heavy engineering equipment for various industries in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)