- India

- /

- Aerospace & Defense

- /

- NSEI:DATAPATTNS

If EPS Growth Is Important To You, Data Patterns (India) (NSE:DATAPATTNS) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Data Patterns (India) (NSE:DATAPATTNS), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Data Patterns (India)

Data Patterns (India)'s Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Data Patterns (India) has achieved impressive annual EPS growth of 43%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

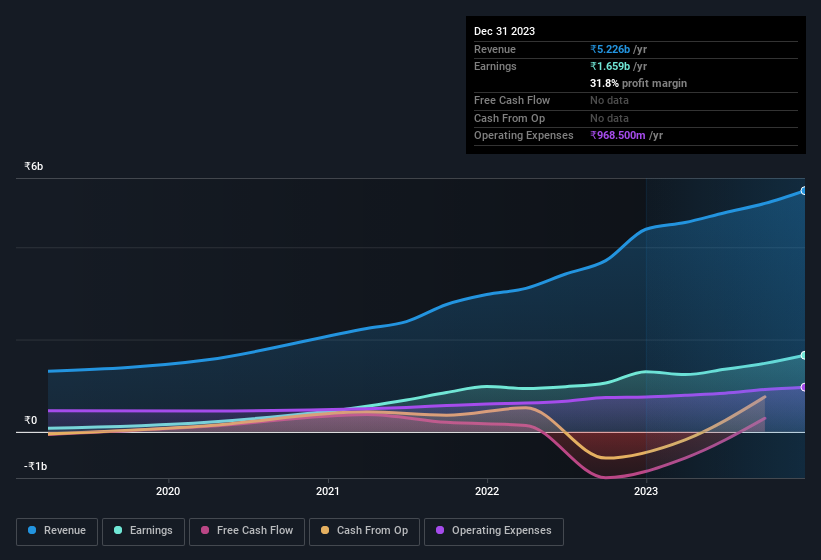

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the one hand, Data Patterns (India)'s EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Data Patterns (India)'s future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Data Patterns (India) Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One gleaming positive for Data Patterns (India), in the last year, is that a certain insider has buying shares with ample enthusiasm. In other words, the Nominee Director, Mathew Cyriac, acquired ₹1.3b worth of shares over the previous 12 months at an average price of around ₹1,837. It doesn't get much better than that, in terms of large investments from insiders.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Data Patterns (India) insiders own more than a third of the company. Indeed, with a collective holding of 56%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. At the current share price, that insider holding is worth a staggering ₹87b. That means they have plenty of their own capital riding on the performance of the business!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Data Patterns (India)'s CEO, Srinivasagopalan Rangarajan, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Data Patterns (India) with market caps between ₹83b and ₹267b is about ₹36m.

The CEO of Data Patterns (India) only received ₹8.7m in total compensation for the year ending March 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Data Patterns (India) To Your Watchlist?

Data Patterns (India)'s earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Data Patterns (India) belongs near the top of your watchlist. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Data Patterns (India) that you should be aware of.

The good news is that Data Patterns (India) is not the only growth stock with insider buying. Here's a list of growth-focused companies in IN with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DATAPATTNS

Data Patterns (India)

Provides defense and aerospace electronics solutions in India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion