Here's Why Blue Star (NSE:BLUESTARCO) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Blue Star (NSE:BLUESTARCO), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Blue Star

How Fast Is Blue Star Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Blue Star has grown EPS by 5.5% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

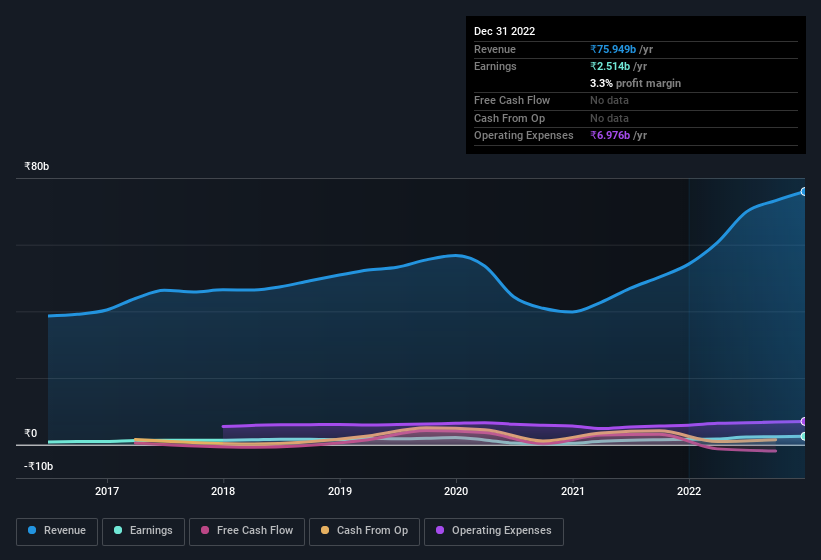

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Blue Star maintained stable EBIT margins over the last year, all while growing revenue 40% to ₹76b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Blue Star's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Blue Star Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Blue Star shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at ₹17b. This totals to 12% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Looking very optimistic for investors.

Is Blue Star Worth Keeping An Eye On?

As previously touched on, Blue Star is a growing business, which is encouraging. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. It is worth noting though that we have found 2 warning signs for Blue Star (1 doesn't sit too well with us!) that you need to take into consideration.

Although Blue Star certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Blue Star might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BLUESTARCO

Blue Star

Operates as a heating, ventilation, air conditioning, and commercial refrigeration (HVAC&R) company in India.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives