How Much Did Asian Granito India's(NSE:ASIANTILES) Shareholders Earn From Share Price Movements Over The Last Three Years?

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of Asian Granito India Limited (NSE:ASIANTILES) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 62% drop in the share price over that period. And the ride hasn't got any smoother in recent times over the last year, with the price 27% lower in that time. Shareholders have had an even rougher run lately, with the share price down 40% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for Asian Granito India

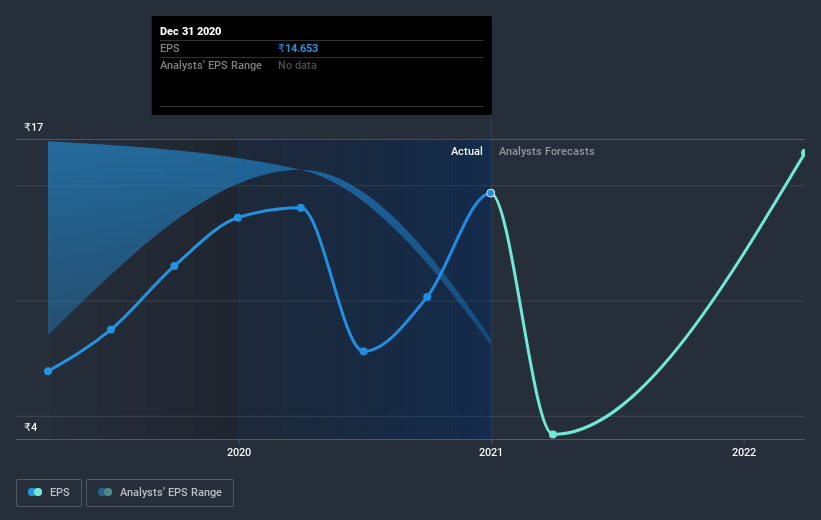

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Asian Granito India saw its EPS decline at a compound rate of 1.0% per year, over the last three years. The share price decline of 27% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Asian Granito India's earnings, revenue and cash flow.

A Different Perspective

Investors in Asian Granito India had a tough year, with a total loss of 27% (including dividends), against a market gain of about 43%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Asian Granito India (1 makes us a bit uncomfortable) that you should be aware of.

Asian Granito India is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Asian Granito India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Asian Granito India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ASIANTILES

Asian Granito India

Manufactures and sells tiles, marbles, sanitaryware, faucets, and quartz products in India.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives