RBL Bank's (NSE:RBLBANK) earnings trajectory could turn positive as the stock rallies 7.4% this past week

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. To wit, the RBL Bank Limited (NSE:RBLBANK) share price managed to fall 70% over five long years. That's not a lot of fun for true believers. On the other hand the share price has bounced 7.4% over the last week.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for RBL Bank

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

RBL Bank became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

We don't think that the 1.0% is big factor in the share price, since it's quite small, as dividends go. In contrast to the share price, revenue has actually increased by 13% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

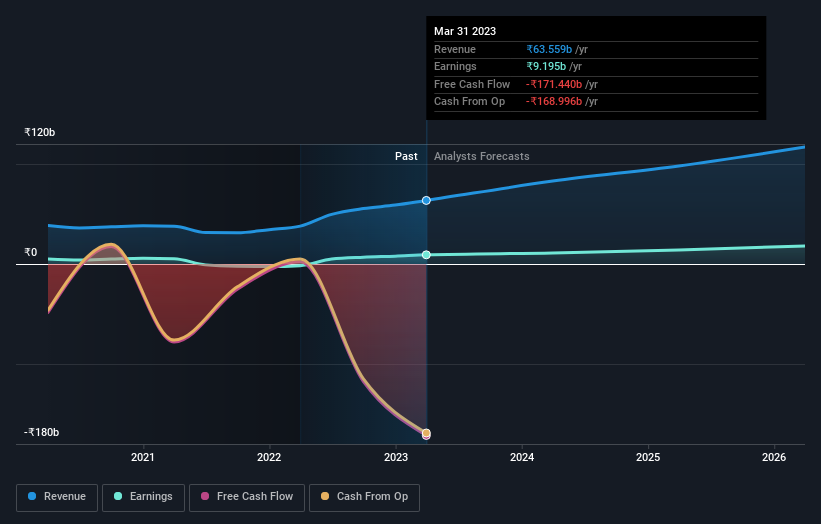

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

RBL Bank is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling RBL Bank stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's nice to see that RBL Bank shareholders have received a total shareholder return of 35% over the last year. And that does include the dividend. That certainly beats the loss of about 11% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for RBL Bank you should be aware of, and 1 of them is a bit concerning.

But note: RBL Bank may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

If you're looking to trade RBL Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RBLBANK

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives