If You Like EPS Growth Then Check Out CSB Bank (NSE:CSBBANK) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in CSB Bank (NSE:CSBBANK). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for CSB Bank

How Fast Is CSB Bank Growing Its Earnings Per Share?

In the last three years CSB Bank's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, CSB Bank's EPS soared from ₹4.35 to ₹6.68, in just one year. That's a impressive gain of 54%.

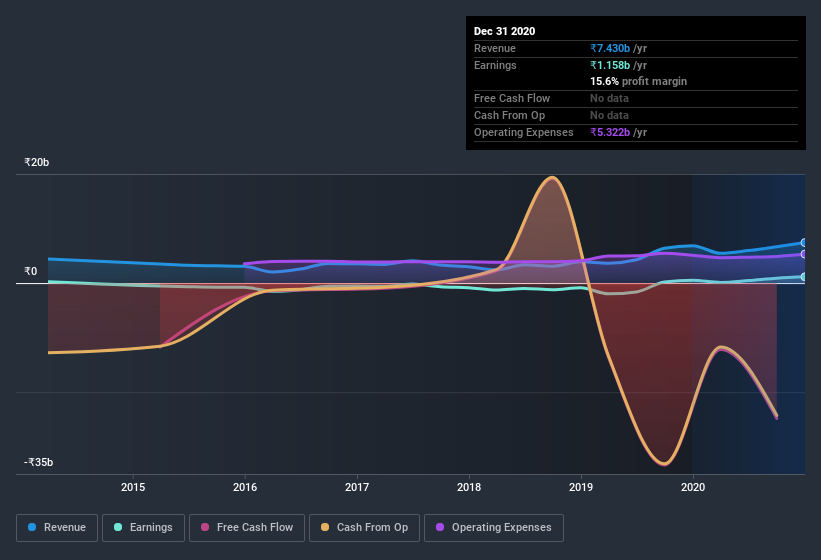

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of CSB Bank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note CSB Bank's EBIT margins were flat over the last year, revenue grew by a solid 8.6% to ₹7.4b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are CSB Bank Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling CSB Bank shares, in the last year. With that in mind, it's heartening that Madhavan Menon, the Non-Executive Director of the company, paid ₹795k for shares at around ₹227 each.

On top of the insider buying, it's good to see that CSB Bank insiders have a valuable investment in the business. To be specific, they have ₹3.3b worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 8.7% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Chinna Rajendran is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between ₹15b and ₹58b, like CSB Bank, the median CEO pay is around ₹25m.

The CSB Bank CEO received total compensation of just ₹7.2m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is CSB Bank Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about CSB Bank's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if CSB Bank is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of CSB Bank, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade CSB Bank, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CSBBANK

CSB Bank

Provides banking and financial services for small and medium enterprises, retail, and non-resident individuals in India.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026