We Ran A Stock Scan For Earnings Growth And Central Bank of India (NSE:CENTRALBK) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Central Bank of India (NSE:CENTRALBK), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Central Bank of India with the means to add long-term value to shareholders.

Check out our latest analysis for Central Bank of India

How Fast Is Central Bank of India Growing Its Earnings Per Share?

Over the last three years, Central Bank of India has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Central Bank of India's EPS catapulted from ₹1.43 to ₹2.51, over the last year. It's a rarity to see 76% year-on-year growth like that. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Central Bank of India's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for Central Bank of India remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 47% to ₹124b. That's encouraging news for the company!

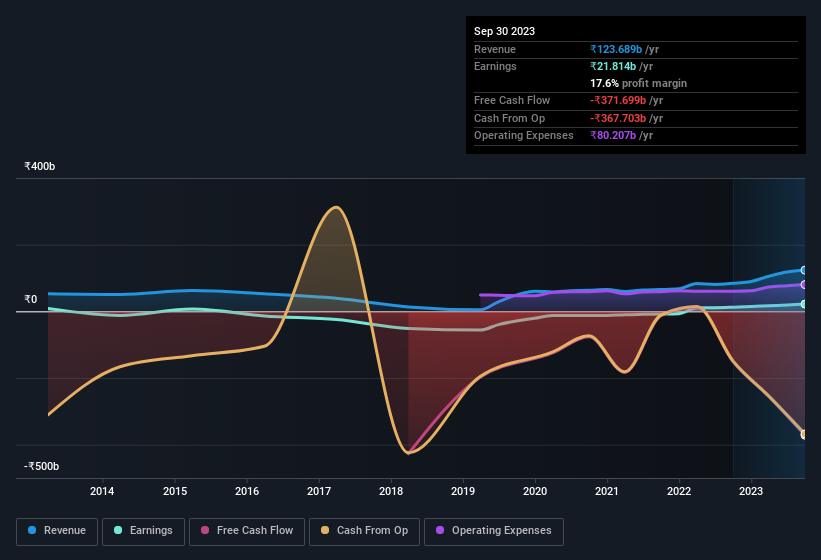

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Central Bank of India's balance sheet strength, before getting too excited.

Are Central Bank of India Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations between ₹333b and ₹1.0t, like Central Bank of India, the median CEO pay is around ₹54m.

The CEO of Central Bank of India was paid just ₹4.1m in total compensation for the year ending March 2023. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Central Bank of India Worth Keeping An Eye On?

Central Bank of India's earnings have taken off in quite an impressive fashion. This appreciable increase in earnings could be a sign of an upward trajectory for the company. At the same time the reasonable CEO compensation reflects well on the board of directors. It will definitely require further research to be sure, but it does seem that Central Bank of India has the hallmarks of a quality business; and that would make it well worth watching. Still, you should learn about the 1 warning sign we've spotted with Central Bank of India.

Although Central Bank of India certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CENTRALBK

Proven track record with adequate balance sheet.

Market Insights

Community Narratives