- India

- /

- Oil and Gas

- /

- NSEI:IOC

3 Top Dividend Stocks On Indian Exchange Yielding Over 3%

Reviewed by Simply Wall St

The market has been flat over the last week but is up 44% over the past year, with earnings expected to grow by 17% per annum over the next few years. In this favorable environment, identifying dividend stocks yielding over 3% can offer a reliable income stream and potential for growth.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.27% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 4.42% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.08% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 7.82% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 5.70% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.65% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.07% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.34% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.71% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.05% | ★★★★★☆ |

Click here to see the full list of 15 stocks from our Top Indian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

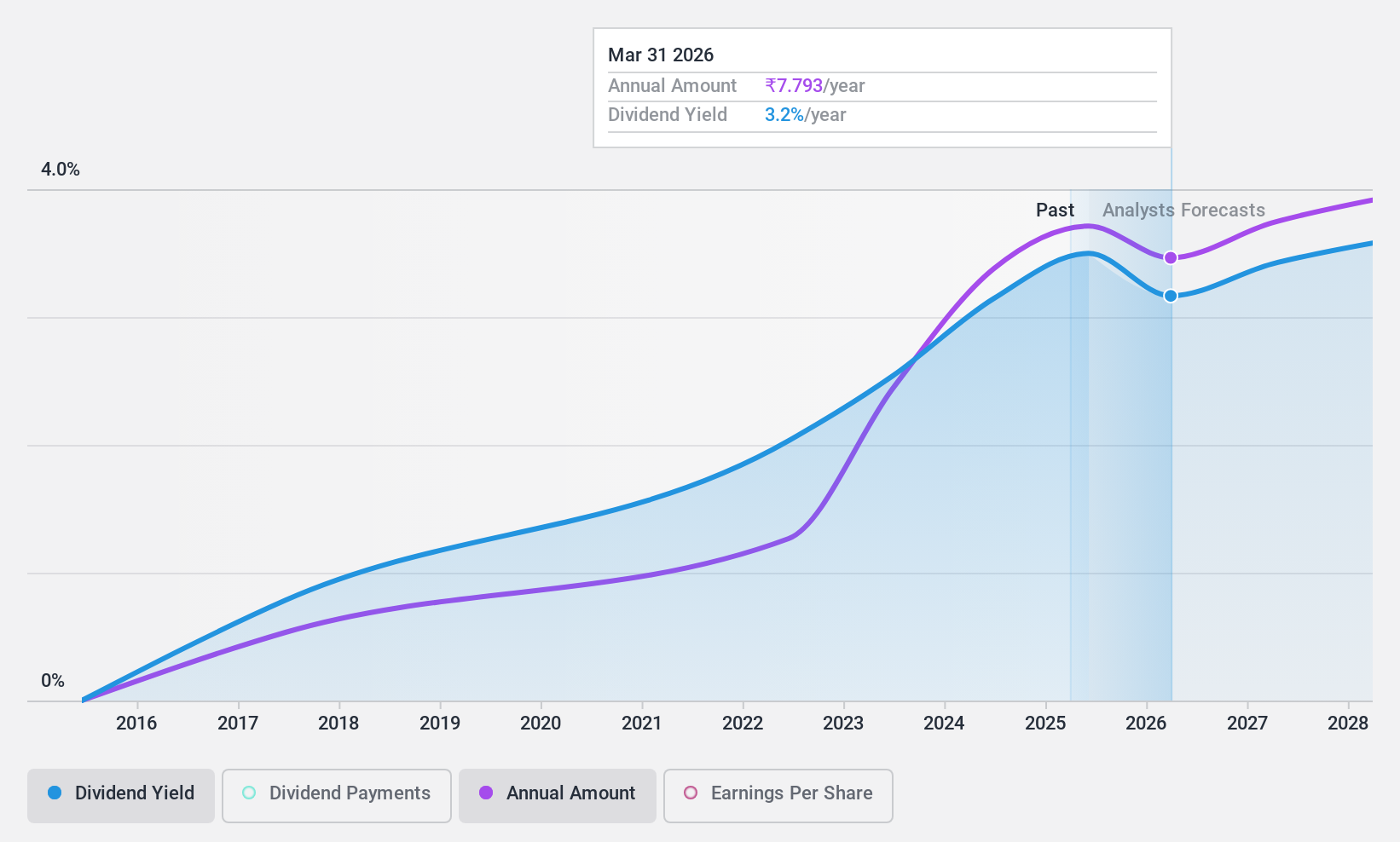

Bank of Baroda (NSEI:BANKBARODA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Baroda Limited offers a range of banking products and services to individuals, government departments, and corporate customers in India and internationally, with a market cap of ₹1.29 trillion.

Operations: Bank of Baroda Limited generates revenue through Treasury (₹316.82 billion), Other Banking Operations (₹110.76 billion), Corporate/Wholesale Banking (₹502.78 billion), and Retail Banking, which includes Digital Banking (₹7.40 million) and Other Retail Banking (₹512.25 billion).

Dividend Yield: 3.1%

Bank of Baroda, trading 13.7% below its estimated fair value, offers a dividend yield of 3.05%, placing it in the top 25% of Indian market dividend payers. Despite an unstable track record with volatile payments over the past decade, recent earnings growth and a low payout ratio (20.9%) suggest dividends are currently well-covered by earnings and forecasted to remain sustainable at a 22.2% payout ratio in three years.

- Click to explore a detailed breakdown of our findings in Bank of Baroda's dividend report.

- Upon reviewing our latest valuation report, Bank of Baroda's share price might be too pessimistic.

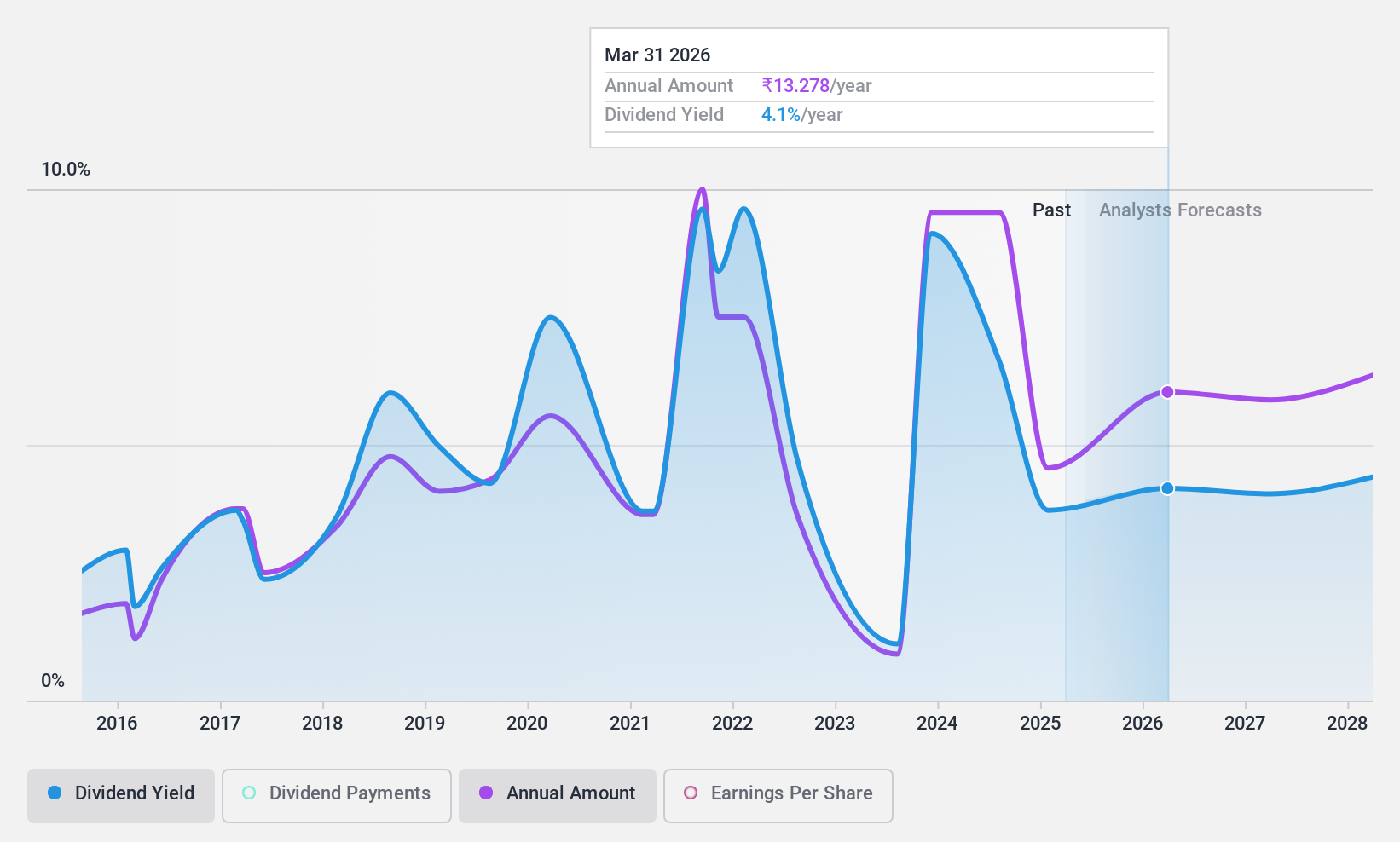

Bharat Petroleum (NSEI:BPCL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited primarily engages in refining crude oil and marketing petroleum products in India and internationally, with a market cap of ₹1.60 trillion.

Operations: Bharat Petroleum Corporation Limited generates revenue from two main segments: Downstream Petroleum, which contributes ₹5.07 billion, and Exploration & Production of Hydrocarbons, accounting for ₹1.92 billion.

Dividend Yield: 5.7%

Bharat Petroleum Corporation Limited's dividend yield of 5.7% ranks it in the top 25% of Indian market dividend payers. While its payout ratio is a low 33.3%, indicating dividends are well-covered by earnings, the company has a high debt level and an unstable dividend track record over the past decade. Recent strategic joint ventures in renewable energy and biogas sectors may impact future performance, but current dividends remain sustainable with a cash payout ratio of 34.6%.

- Click here to discover the nuances of Bharat Petroleum with our detailed analytical dividend report.

- Our valuation report unveils the possibility Bharat Petroleum's shares may be trading at a discount.

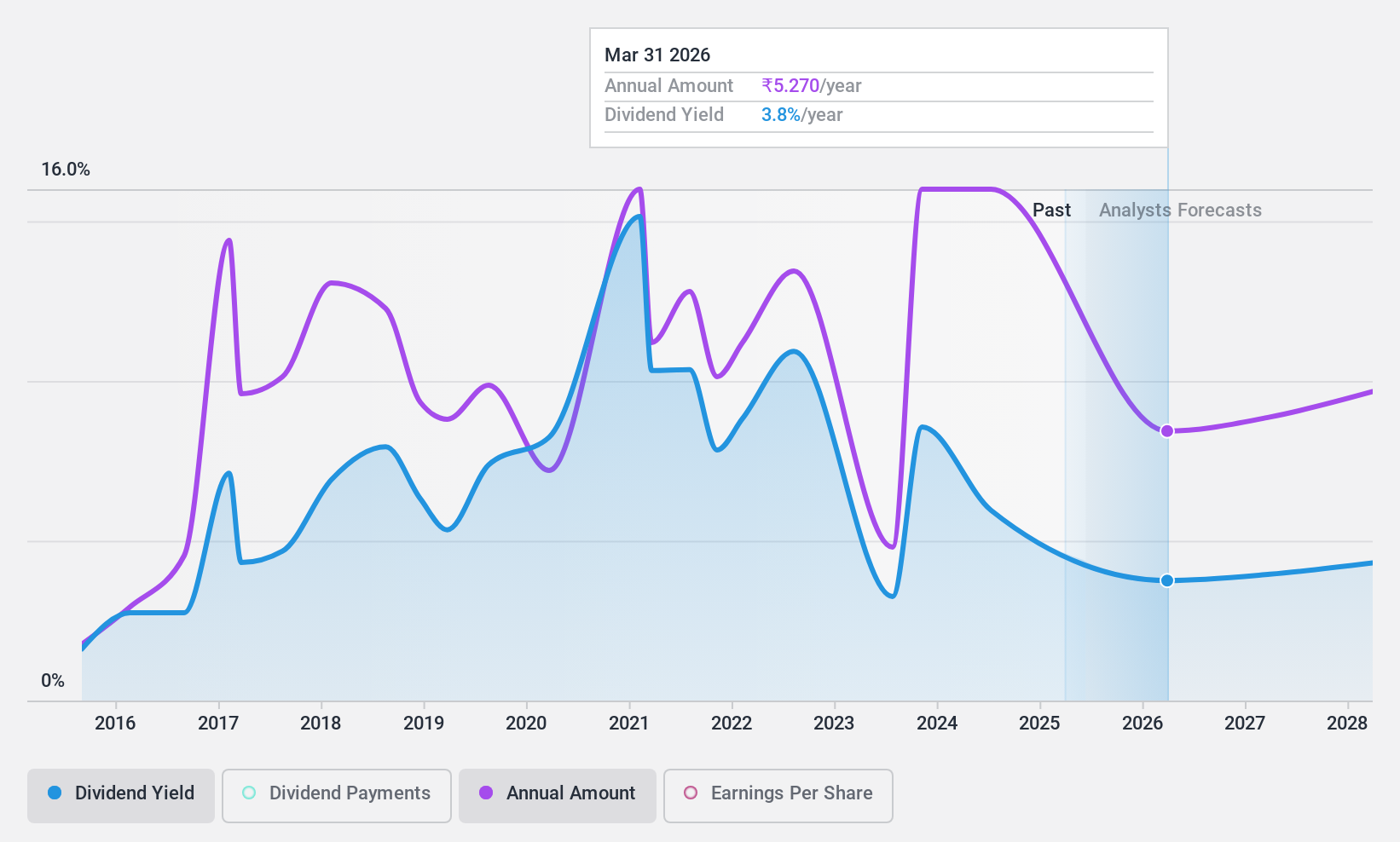

Indian Oil (NSEI:IOC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited, with a market cap of ₹2.47 trillion, refines, pipeline transports, and markets petroleum products in India and internationally through its subsidiaries.

Operations: Indian Oil Corporation Limited generates revenue primarily from petroleum products (₹8.25 billion) and petrochemicals (₹262.95 million).

Dividend Yield: 7.8%

Indian Oil Corporation Limited's dividend yield of 7.82% places it in the top 25% of Indian market dividend payers. Despite a volatile dividend history over the past decade, recent increases suggest some growth potential. The company's dividends are well-covered by earnings (payout ratio: 39.6%) and cash flows (cash payout ratio: 56.8%). However, with a high level of debt and forecasted earnings decline, sustainability remains uncertain amidst ongoing executive changes and strategic adjustments.

- Get an in-depth perspective on Indian Oil's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Indian Oil is trading behind its estimated value.

Where To Now?

- Unlock more gems! Our Top Indian Dividend Stocks screener has unearthed 12 more companies for you to explore.Click here to unveil our expertly curated list of 15 Top Indian Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IOC

Indian Oil

Indian Oil Corporation Limited, together with its subsidiaries, refines, pipeline transports, and markets petroleum products in India and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives