- India

- /

- Auto Components

- /

- NSEI:NDRAUTO

NDR Auto Components (NSE:NDRAUTO) Seems To Use Debt Quite Sensibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that NDR Auto Components Limited (NSE:NDRAUTO) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for NDR Auto Components

What Is NDR Auto Components's Debt?

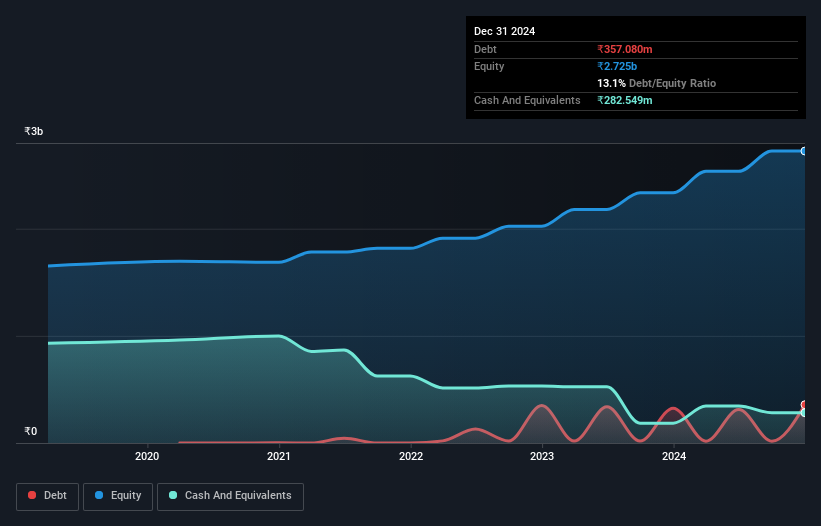

You can click the graphic below for the historical numbers, but it shows that as of September 2024 NDR Auto Components had ₹357.1m of debt, an increase on ₹324.8m, over one year. However, it does have ₹282.5m in cash offsetting this, leading to net debt of about ₹74.5m.

How Strong Is NDR Auto Components' Balance Sheet?

We can see from the most recent balance sheet that NDR Auto Components had liabilities of ₹1.16b falling due within a year, and liabilities of ₹316.1m due beyond that. Offsetting these obligations, it had cash of ₹282.5m as well as receivables valued at ₹967.5m due within 12 months. So it has liabilities totalling ₹226.6m more than its cash and near-term receivables, combined.

Having regard to NDR Auto Components' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the ₹14.4b company is struggling for cash, we still think it's worth monitoring its balance sheet. Carrying virtually no net debt, NDR Auto Components has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

NDR Auto Components has a low net debt to EBITDA ratio of only 0.11. And its EBIT covers its interest expense a whopping 59.9 times over. So we're pretty relaxed about its super-conservative use of debt. On top of that, NDR Auto Components grew its EBIT by 42% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is NDR Auto Components's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, NDR Auto Components recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

The good news is that NDR Auto Components's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. Taking all this data into account, it seems to us that NDR Auto Components takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. Over time, share prices tend to follow earnings per share, so if you're interested in NDR Auto Components, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NDR Auto Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NDRAUTO

NDR Auto Components

Manufactures, fabricates, assembles, sells, and trades in automotive components for passenger cars and utility vehicles in India.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)