- India

- /

- Auto Components

- /

- NSEI:MSUMI

Here's Why Motherson Sumi Wiring India (NSE:MSUMI) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Motherson Sumi Wiring India (NSE:MSUMI), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Motherson Sumi Wiring India

How Fast Is Motherson Sumi Wiring India Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Motherson Sumi Wiring India's EPS skyrocketed from ₹0.90 to ₹1.32, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 47%.

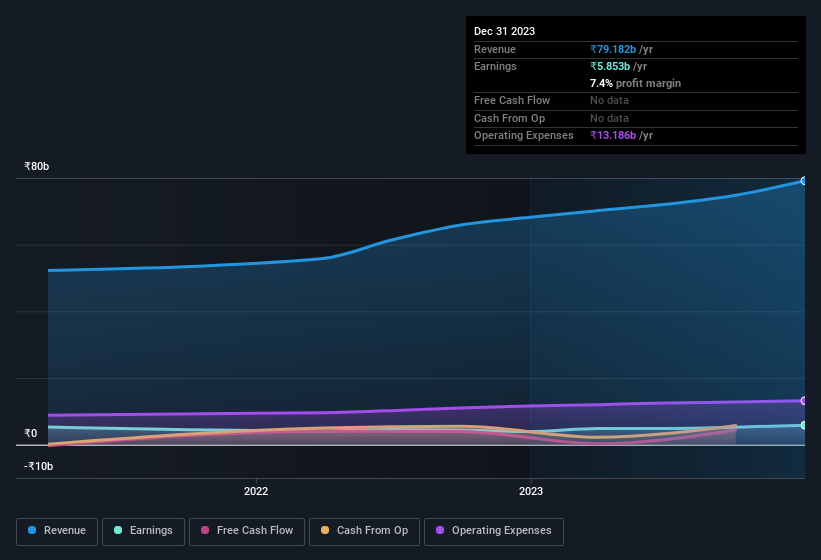

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Motherson Sumi Wiring India remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 16% to ₹79b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Motherson Sumi Wiring India's future EPS 100% free.

Are Motherson Sumi Wiring India Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Motherson Sumi Wiring India shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at ₹8.8b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between ₹166b and ₹531b, like Motherson Sumi Wiring India, the median CEO pay is around ₹44m.

Motherson Sumi Wiring India's CEO took home a total compensation package of ₹15m in the year prior to March 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Motherson Sumi Wiring India Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Motherson Sumi Wiring India's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that Motherson Sumi Wiring India has underlying strengths that make it worth a look at. It is worth noting though that we have found 1 warning sign for Motherson Sumi Wiring India that you need to take into consideration.

Although Motherson Sumi Wiring India certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MSUMI

Motherson Sumi Wiring India

Engages in the manufacture and sale of components to automotive original equipment manufacturers in India and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives