- India

- /

- Auto Components

- /

- NSEI:CIEINDIA

CIE Automotive India Limited (NSE:CIEINDIA) Looks Inexpensive But Perhaps Not Attractive Enough

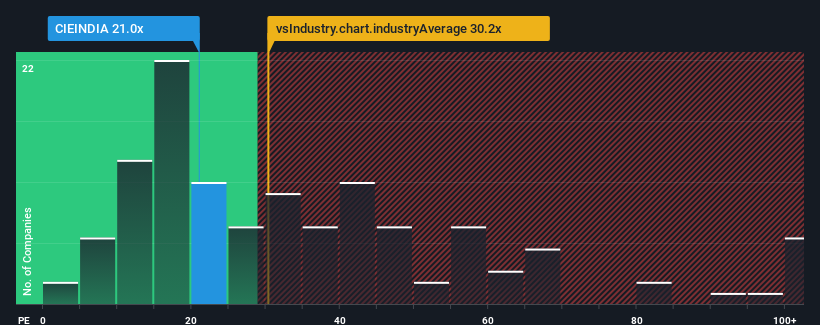

With a price-to-earnings (or "P/E") ratio of 21x CIE Automotive India Limited (NSE:CIEINDIA) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 27x and even P/E's higher than 52x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, CIE Automotive India's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for CIE Automotive India

What Are Growth Metrics Telling Us About The Low P/E?

CIE Automotive India's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.5%. Even so, admirably EPS has lifted 47% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 7.9% each year during the coming three years according to the six analysts following the company. That's shaping up to be materially lower than the 20% per annum growth forecast for the broader market.

In light of this, it's understandable that CIE Automotive India's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of CIE Automotive India's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for CIE Automotive India with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than CIE Automotive India. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CIEINDIA

CIE Automotive India

Produces and sells automotive components to original equipment manufacturers and other customers in India, Europe, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives