- India

- /

- Auto Components

- /

- NSEI:BHARATGEAR

Shareholders May Not Be So Generous With Bharat Gears Limited's (NSE:BHARATGEAR) CEO Compensation And Here's Why

In the past three years, the share price of Bharat Gears Limited (NSE:BHARATGEAR) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also poor, despite revenues growing. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 22 September 2021, where they can impact on future company performance by voting on resolutions, including executive compensation. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for Bharat Gears

How Does Total Compensation For SPK Kanwar Compare With Other Companies In The Industry?

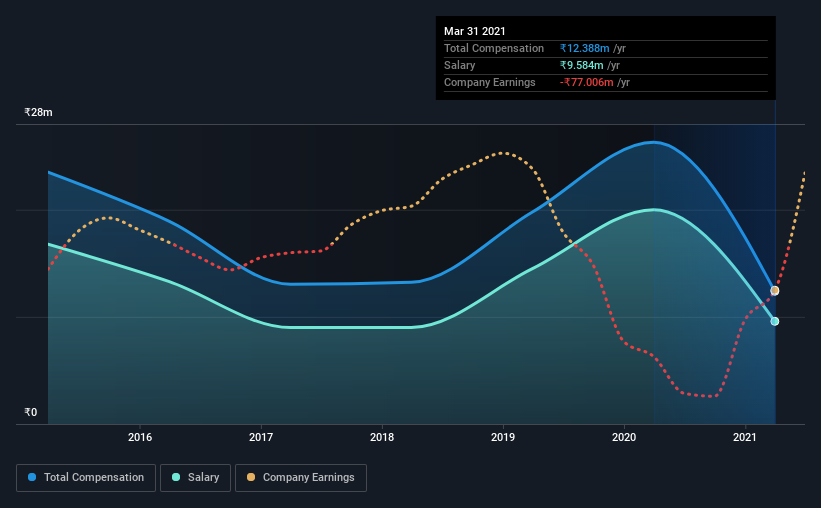

Our data indicates that Bharat Gears Limited has a market capitalization of ₹1.4b, and total annual CEO compensation was reported as ₹12m for the year to March 2021. We note that's a decrease of 53% compared to last year. Notably, the salary which is ₹9.58m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹7.8m. Accordingly, our analysis reveals that Bharat Gears Limited pays SPK Kanwar north of the industry median. Moreover, SPK Kanwar also holds ₹495m worth of Bharat Gears stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹9.6m | ₹20m | 77% |

| Other | ₹2.8m | ₹6.3m | 23% |

| Total Compensation | ₹12m | ₹26m | 100% |

Speaking on an industry level, nearly 74% of total compensation represents salary, while the remainder of 26% is other remuneration. Although there is a difference in how total compensation is set, Bharat Gears more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Bharat Gears Limited's Growth

Over the last three years, Bharat Gears Limited has shrunk its earnings per share by 1.8% per year. Its revenue is up 56% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Bharat Gears Limited Been A Good Investment?

Given the total shareholder loss of 16% over three years, many shareholders in Bharat Gears Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for Bharat Gears (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Bharat Gears or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bharat Gears might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:BHARATGEAR

Bharat Gears

Manufactures and supplies automotive gear in India, the United States, Mexico, Spain, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)