- Israel

- /

- Renewable Energy

- /

- TASE:OPCE

OPC Energy (TASE:OPCE): Is the Recent Valuation Justified After a Year of Notable Share Price Swings?

Reviewed by Kshitija Bhandaru

OPC Energy (TASE:OPCE) has caught the attention of investors as its stock price made some notable swings this year. While there is no major headline driving today's move, many are wondering if this recent activity is signaling a shift in investor expectations or simply background noise. Either way, OPC Energy’s price fluctuations are giving potential investors plenty to think about if they are trying to figure out whether now is the right time to get in or stay on the sidelines.

Looking at the numbers, OPC Energy’s shares are up a strong 72% over the past year, with solid momentum especially over the past three months, where gains have topped 21%. That stands in contrast to the past month, when the stock dipped about 5%. Brief pullbacks like this are common after periods of sustained growth and could reflect shifting sentiment or profit-taking, especially given the broader context of the market.

So after an impressive run this year, the question facing investors is clear: is OPC Energy undervalued right now, or is the market already factoring in all the possible future growth?

Price-to-Earnings of 82.3x: Is it justified?

OPC Energy is currently trading at a price-to-earnings (P/E) ratio of 82.3x, which is significantly higher than both its peer average of 20.7x and the Asian Renewable Energy industry average of 15.9x. This suggests that, relative to comparable companies and the sector, OPC Energy shares appear expensive.

The price-to-earnings ratio is an important metric that indicates how much investors are willing to pay for each shekel of the company's earnings. A high P/E ratio can sometimes reflect investor optimism about a company’s future profit growth, or it could indicate that the market has pushed the stock price above what current earnings justify.

In this case, the implication is clear: the market is pricing in a strong outlook or unique qualities for OPC Energy compared to its peers. However, with a P/E ratio far above industry norms, investors should ask whether the company’s earnings trajectory can keep up with these expectations or if the stock is simply overvalued.

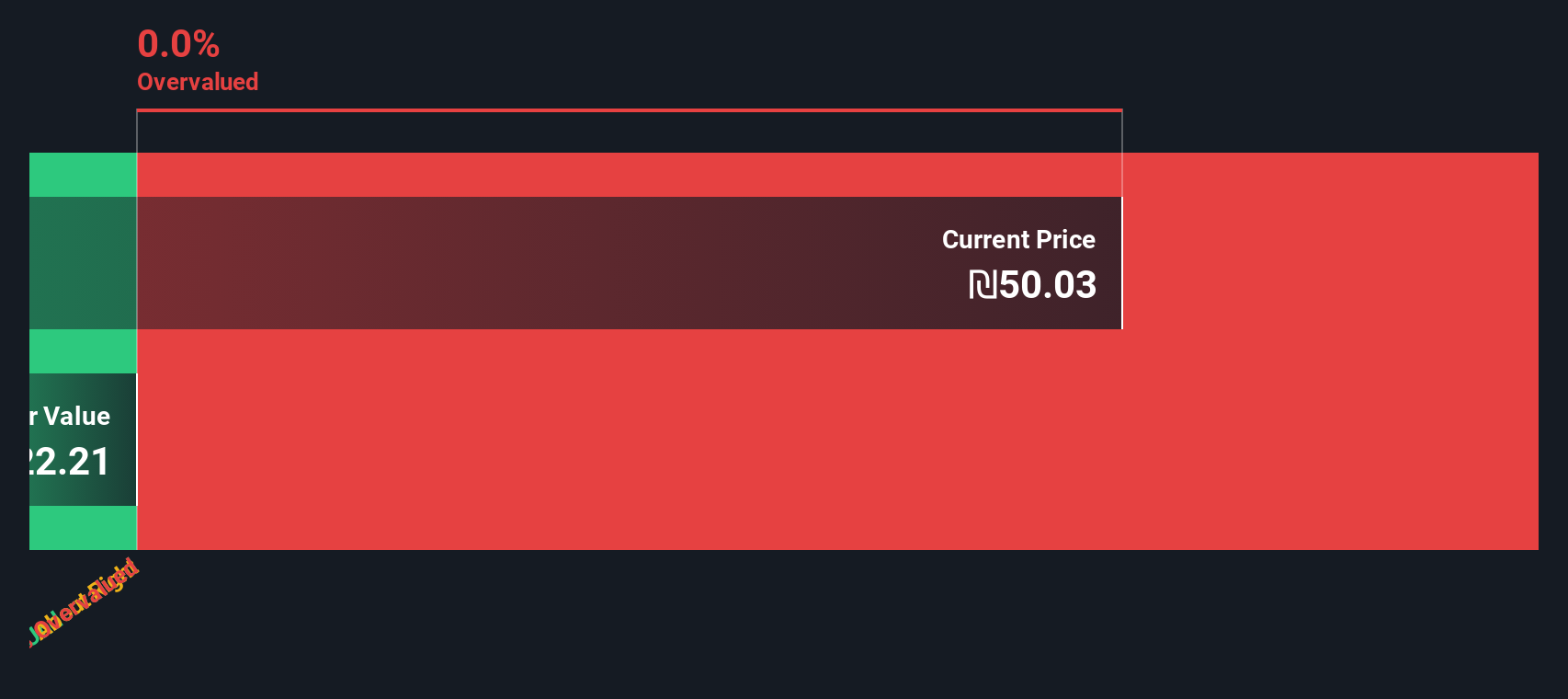

Result: Fair Value of $50.03 (OVERVALUED)

See our latest analysis for OPC Energy.However, unexpected earnings shortfalls or shifting industry dynamics could quickly challenge the optimistic outlook that is currently priced into OPC Energy’s shares.

Find out about the key risks to this OPC Energy narrative.Another View: What About a DCF Model?

While multiples say OPC Energy looks expensive, our SWS DCF model can offer a different perspective by estimating the company’s value based on its future cash flows. But what does this approach reveal? Do the numbers still point to overvaluation, or is there more to the story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own OPC Energy Narrative

If you see things differently or prefer to dig into the numbers on your own, it only takes a few minutes to shape your personal view, so Do it your way.

A great starting point for your OPC Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that broadening their horizons uncovers opportunities others overlook. Don’t miss your edge. Set your sights on future winners with these powerful tools:

- Boost your potential portfolio returns by tracking market underdogs that often trade below their true worth, using our undervalued stocks based on cash flows.

- Tap into the artificial intelligence movement by spotting dynamic innovators redefining the tech landscape. Start with our AI penny stocks.

- Strengthen your income strategy with access to companies offering exceptional payouts, all highlighted in our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:OPCE

OPC Energy

Engages in the development, construction, operation, generation, and supply of electricity in Israel.

Solid track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives