- Israel

- /

- Renewable Energy

- /

- TASE:DORL

Doral Group Renewable Energy Resources (TLV:DORL) shareholder returns have been , earning 13% in 1 year

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. To wit, the Doral Group Renewable Energy Resources Ltd (TLV:DORL) share price is 13% higher than it was a year ago, much better than the market return of around 9.6% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Doral Group Renewable Energy Resources for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Before we look at the performance, you might like to know that our analysis indicates that DORL is potentially overvalued!

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months Doral Group Renewable Energy Resources went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

However the year on year revenue growth of 109% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

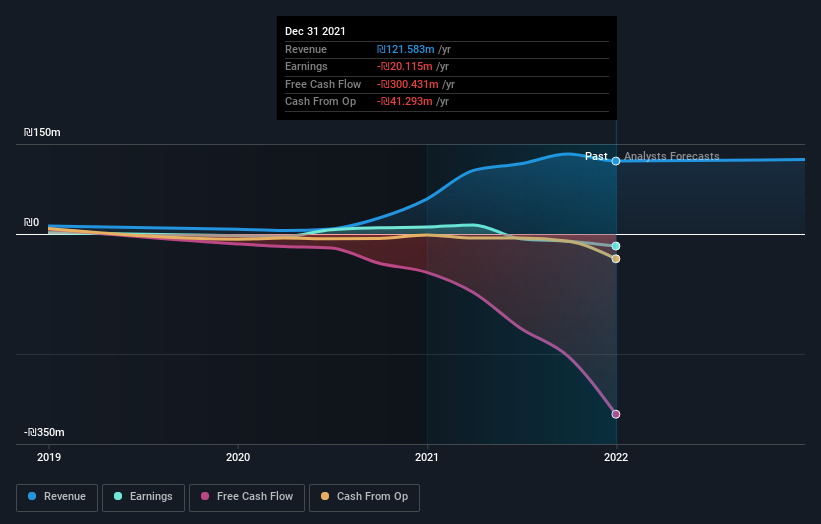

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Doral Group Renewable Energy Resources' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

In the last year the market returned about 13%, and Doral Group Renewable Energy Resources generated a TSR of 13% for its shareholders. A substantial portion of that gain has come in the last three months, with the stock up 25% in that time. It could be that word is spreading about its positive business attributes. It's always interesting to track share price performance over the longer term. But to understand Doral Group Renewable Energy Resources better, we need to consider many other factors. For instance, we've identified 3 warning signs for Doral Group Renewable Energy Resources (1 is concerning) that you should be aware of.

But note: Doral Group Renewable Energy Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:DORL

Doral Group Renewable Energy Resources

Operates renewable energy, solar energy, and energy storage facilities in the United States of America, Israel, and Europe.

Low risk and overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)