- Israel

- /

- Electronic Equipment and Components

- /

- TASE:TEDE

Does Tedea Technological Development and Automation (TLV:TEDE) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Tedea Technological Development and Automation Ltd. (TLV:TEDE) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Tedea Technological Development and Automation

What Is Tedea Technological Development and Automation's Net Debt?

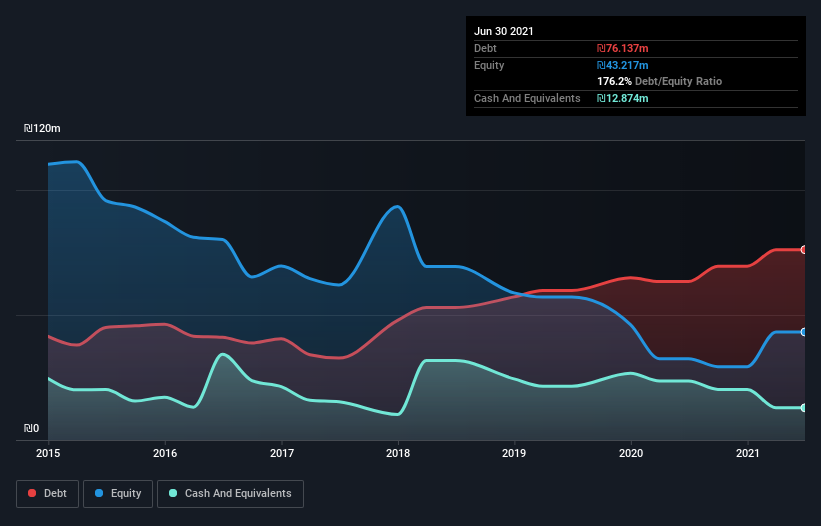

As you can see below, at the end of June 2021, Tedea Technological Development and Automation had ₪76.1m of debt, up from ₪63.4m a year ago. Click the image for more detail. On the flip side, it has ₪12.9m in cash leading to net debt of about ₪63.3m.

How Strong Is Tedea Technological Development and Automation's Balance Sheet?

The latest balance sheet data shows that Tedea Technological Development and Automation had liabilities of ₪68.6m due within a year, and liabilities of ₪26.0m falling due after that. Offsetting these obligations, it had cash of ₪12.9m as well as receivables valued at ₪59.3m due within 12 months. So it has liabilities totalling ₪22.4m more than its cash and near-term receivables, combined.

Since publicly traded Tedea Technological Development and Automation shares are worth a total of ₪117.5m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Tedea Technological Development and Automation's net debt is 4.1 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 14.9 times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. Pleasingly, Tedea Technological Development and Automation is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 1,337% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Tedea Technological Development and Automation's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last two years, Tedea Technological Development and Automation burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Tedea Technological Development and Automation is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about Tedea Technological Development and Automation's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 5 warning signs with Tedea Technological Development and Automation (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Tedea Technological Development and Automation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:TEDE

Tedea Technological Development and Automation

Through its subsidiaries, manufactures, imports, markets, and sells building materials in Israel.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.